Good morning, everyone. I hope you had a fantastic Thanksgiving weekend! This morning we’ve got listener questions, some dives into blockchain basics, and of course, your crypto prices.

Listener Questions

Ethan Asks: "What is Blockchain, and how does it work?"

Ethan, this is a big one, so let’s simplify: blockchain is a digital ledger—think of it like a tamper-resistant database spread across many computers. Each "block" contains transactions, and once it’s full, it links to the previous block, forming a chain. This system makes it nearly impossible to alter or delete data, offering transparency and security.

Blockchain relies on triple-entry accounting. Traditional accounting uses two entries—debits and credits. Blockchain adds a third: a cryptographic record stored on a decentralized network, which anyone can verify but no one can easily manipulate.

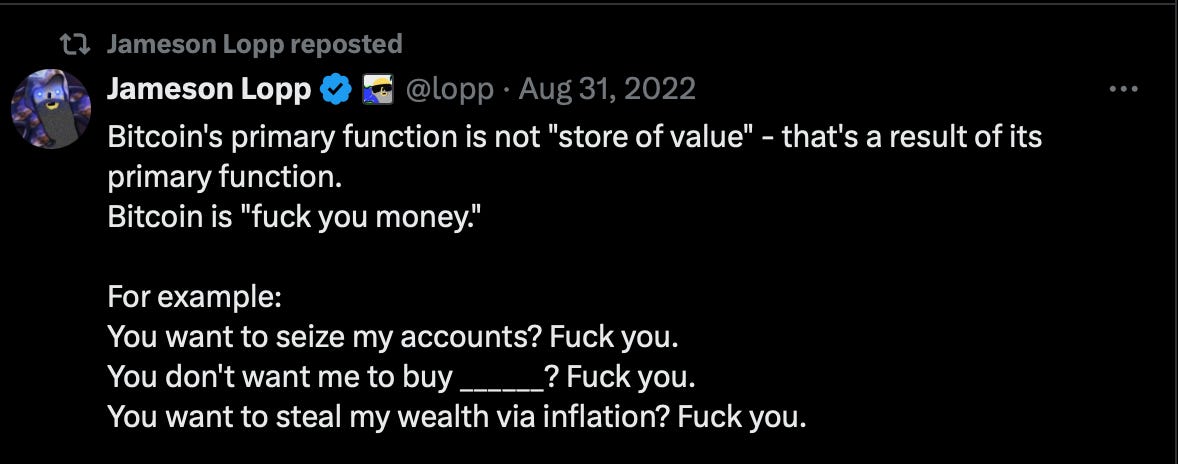

Bitcoin, the OG, is capped at 21 million coins, which prevents inflation—unlike fiat currencies that governments can endlessly print. It's also permissionless (no gatekeepers) and trustless (you don’t rely on a middleman, like a bank).

As for security, Bitcoin’s proof-of-work system ensures the ledger is insanely difficult to tamper with. Even a well-funded adversary would find it cheaper to use Bitcoin than to attack it. This is why Bitcoin stands out as F-U money: no one can seize it, inflate it, or control how you use it. For a deeper dive, check out Mastering Bitcoin by Andreas Antonopoulos—link in the show notes.

Tao Asks: "What’s the best way to move crypto profits back to fiat without huge fees?"

Tao, the good news is, there are plenty of options that won’t break the bank. Centralized exchanges like Kraken, Gemini, and Crypto.com have very low trading fees—often less than $2 per $1,000 traded. Even Coinbase’s advanced trading option can save you money compared to their standard fees. For deposits and withdrawals via ACH or SEPA, most major exchanges don’t charge fees at all.

If you're concerned about taxes, remember: those fees can be factored into your cost basis. While Coinbase is notorious for high fees, alternatives like Kraken or Gemini often offer cheaper options for cashing out.

Crypto Prices

Let’s check where the markets stand:

Bitcoin (BTC): $97,058 (flat in 24h, bouncing between $95.9K and $97.5K)

Ethereum (ETH): $3,668 (-1.6%)

XRP: $2.71 (+43.4% in 24h)

Solana (SOL): $229 (-4%)

Binance Coin (BNB): $649 (-2%)

Dogecoin (DOGE): $0.436 (+0.5%)

Cardano (ADA): $1.20 (+12.1%)

Avalanche (AVAX): $49.06 (+8%)

Market Cap: The total market cap is sitting at $3.48 trillion, up 1.2%. Bitcoin dominates with $1.92 trillion, and Ethereum accounts for $442 billion.

That’s it for today!

Thanks for tuning in to the Daily Crypto News. Make sure to subscribe, leave a comment, and hit those five stars. Craig Cobb’s TA episode will drop later today—keep an eye out for that. Until tomorrow, happy hodling, everyone!