Good morning! A rare Saturday drop because yesterday’s interview on crypto Roth IRAs lit up our inbox. Today’s note is a little chiller, a little rantier, and packed with your questions, news we’re tracking, and a quick market wrap.

P.S. If you’re exploring a self-custody crypto Roth IRA, check out Athenic — and use code DCN for $30 off your signup: athenic.xyz. We’re affiliates; it saves you money and supports the show.

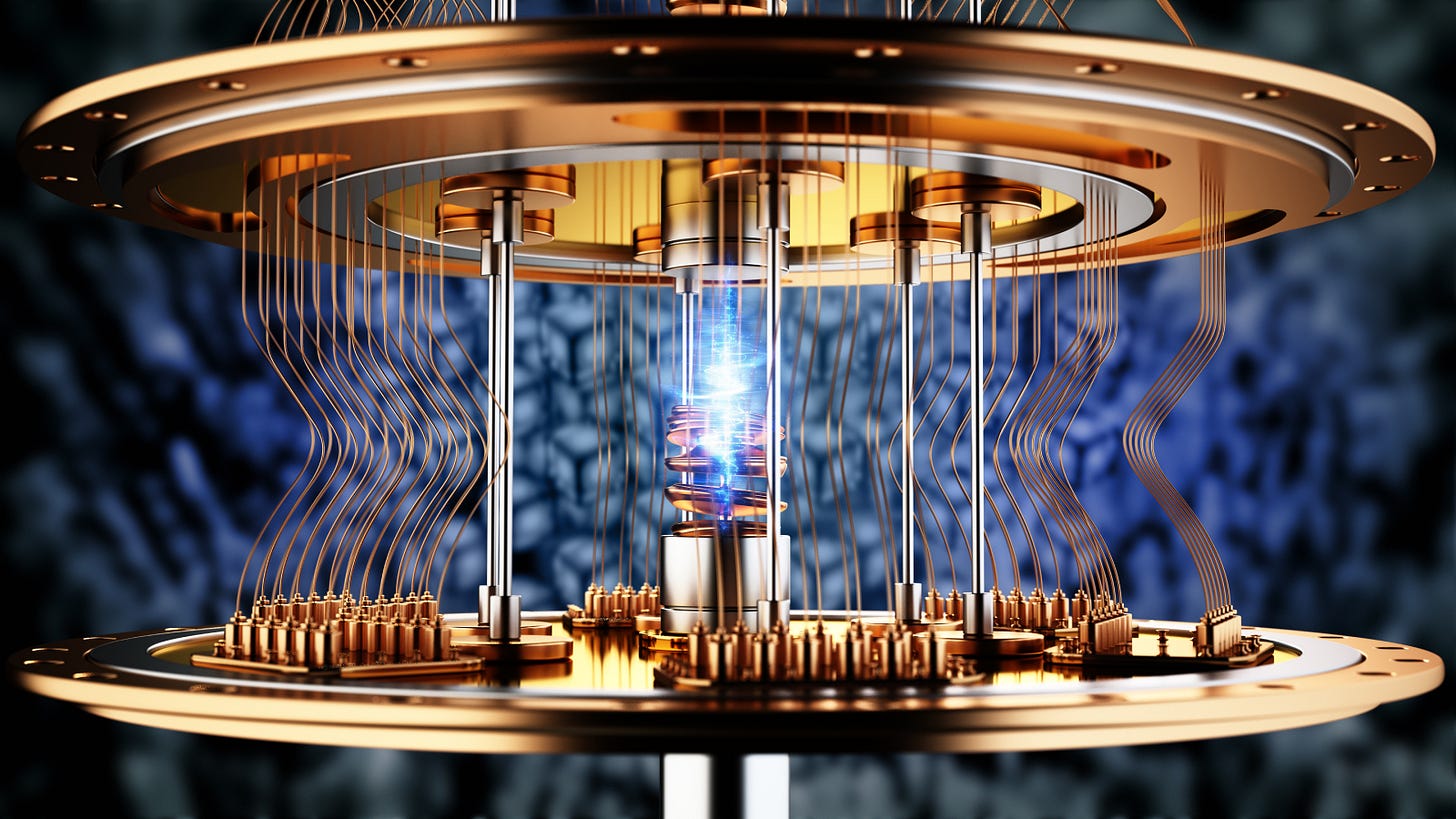

🧑💻 Quantum Computing FUD: Will It Dwarf Blockchain Security?

🏦 Coinbase Expands USDC On-Chain Lending

Self Custody Crypto Roth IRA:

http://athenic.xyz/

Use Code “DCN” for $30 off: DCN

📉 Trader Cobb & Market Training via The Grow Me Co

Today’s Big Take: Quantum FUD vs. Bitcoin’s Future

There’s persistent chatter that quantum computing will nuke SHA-256 and wreck Bitcoin. Sussex researchers have sketched what it might take to crack keys “in hours,” but the stability and scale required are still beyond today’s machines. That said, tech rarely moves linearly. Solana’s Anatoly Yakovenko pegs the risk at ~50/50 by 2030.

My view: assume breakthroughs happen sooner than expected and make this the last halving before Bitcoin hardens its quantum posture. If a real quantum break appeared tomorrow, nobody would announce it—first move would be testing Satoshi-era coins to shock the chain and OTC offload. Plan for that tail risk; don’t hand-wave it away.

Coinbase’s New USDC Lending: 10.8% (…Subject to Liquidity)

Coinbase rolled out an on-chain USDC lending route (via Base + Morpho/Stakehouse vaults) showing yields up to 10.8%. It’s DeFi-powered, not the custodial 4.1–4.5% savings you’ve seen.

Why I’m cautious:

“Withdraw anytime, subject to liquidity” is doing heavy lifting.

Smart-contract risk and counterparty dynamics are real.

Beautiful yields tend to carry ugly caveats.

Does it mean “don’t touch”? Not advice—just underwrite the risks, size positions sanely, and understand that “subject to liquidity” can mean you wait.

Cold Wallets, Blocks, and Off-Ramps (Listener Q)

A listener moved family XRP from Coinbase to a cold wallet and got blocked twiceas “suspicious.” Annoying? Absolutely. But remember: exchanges are centralizedand bound to KYC/AML. They will sometimes over-correct.

How I bucket the risk (not financial advice):

Hot: Small amounts on 2 exchanges max for speed/opportunity (I prefer ones with responsive support; Kraken has treated me well).

Cold: Core stack on hardware (but only if you can manage seed hygiene; know yourself).

Cash: A real-world cushion so you’re not forced to sell crypto in a crunch.

Need fiat? You’ll still off-ramp through an exchange or a trusted OTC desk. Peer-to-peer cashing out with strangers is not a risk I endorse in 2025.

FTX Payout Watch

FTX expects to distribute ~$1.6B to creditors on Sept 30. If you have a claim, watch your inboxes and official portals; secondary rumors aren’t settlement.

Why I Don’t Touch Tron (And a Few Others)

I keep getting: “Why the TRON hate?” It’s mostly gut + patterns: enormous stablecoin flow outside tight U.S. oversight; repeated reports tying bad actors to USDT on TRON. Could I be wrong? Sure. But I’d rather route stablecoins on Solana or Ethereum and sleep fine.

Same vibe check keeps me away from crypto․com. Call it scar tissue from the FTX/Celsius era: similar playbooks; different outcomes. Caution is cheap.

Kraken IPO in 2026?

If it happens, I expect a Coinbase-like arc: day-one pop, then gravity. On 24h spot volume, Coinbase is ~$2B, Kraken ~$1B, Gemini ~$124M, while Binance still dwarfs all. Great company doesn’t guarantee a straight-up chart out of the gate. Timing and cycle matter more than the S-1 prose.

From the Hill: The Bitcoin Act Roundtable (Guest Segment)

Maris Badcock (Digital Chamber) briefed us on a D.C. roundtable exploring a bill to allow the U.S. Treasury to hold Bitcoin. No immediate vote—this is blocking and tackling: custody model, budget neutrality, oversight, depoliticization. Bipartisan or bust. The meta-signal: Bitcoin in national reserves is now a serious policy discussion, not a fringe tweet.

Explain It Like I’m My Uncle: “What is a Bitcoin?”

Think triple-entry accounting on a public, cryptographic ledger. Balances and transfers are mathematically enforced, globally auditable, and capped by absolute scarcity (21M BTC). It’s the hardest money we’ve engineered: resistant to dilution, natively digital, and settlement-final by design.

Market Snapshot (9:38 a.m. ET)

Fear & Greed: 48 (Neutral leaning fear)

BTC: $116,000 (−0.2%)

ETH: $4,473 (−1.0%)

BNB: $1,000 (+1.0%)

SOL: $238 (−1.3%)

XRP: $0.299 (−1.4%)

DOGE: $0.266 (−1.6%)

TRX: $0.347 (flat)

ADA: $0.898 (−0.8%)

Total MC: $4.04T (−0.5%) — BTC $2.3T, ETH $540B

Parting Shot

If you’re serious about tax-free compounding and want it on-chain with self-custody, the tool we keep hearing about from power users is Athenic. Again, use code DCN for $30 off at athenic.xyz. You can do Roth or Traditional, but around here… we’re team Roth.

Happy hodling. See you Monday.