Good morning everyone, it’s your Daily Crypto News for Tuesday, October 28, 2025. I’m Matt, and here’s what’s happening in crypto and beyond.

Myriad Expands to BNB Chain

“Myriad is a prediction market platform, and it just launched on BNB, expanding into one of the world’s busiest blockchain ecosystems.”

Myriad continues its multichain expansion, now adding BNB Chain to its growing footprint after prior launches on Abstract and Linea. The platform’s new rollout includes a Mandarin-language interface and localized prediction markets tailored for Asian users. Alongside this expansion, Myriad introduced “Automated Markets,” which feature quick, auto-resolving predictions for continuous trading — a move designed to attract global traders looking for speed and simplicity.

My Take:

This is exactly what prediction markets have needed — accessibility and language localization. Myriad’s push into Asia with auto-resolving markets is a smart strategic move that signals how decentralized prediction platforms are starting to behave like real global financial products.

Japan Launches Its First Yen-Backed Stablecoin

“Japan introduced its first yen-backed stablecoin, JPYC, fully collateralized by bank deposits and government bonds.”

Japan has officially entered the stablecoin race with JPYC — a fully regulated, yen-backed digital asset. The stablecoin, issued by JPYC Inc., adheres to new Japanese digital asset laws ensuring full collateralization through bank deposits and government bonds. The company aims for a 10 trillion yen issuance within three years. With major Japanese banks preparing rival products, the stage is set for an intense domestic stablecoin competition that could modernize Japan’s financial infrastructure.

My Take:

Japan’s stablecoin framework is one of the most responsible approaches to date. It’s government-bond backed, regulated, and transparent — everything the U.S. still hasn’t fully figured out. This could be a model for how traditional financial systems evolve alongside crypto.

Western Union Enters the Stablecoin Game

“Western Union announced a pilot using stablecoins for cross-border remittances, aiming to cut costs and improve speed across its 200-country network.”

Western Union has begun testing stablecoin payments for global money transfers, hoping to reduce fees and settlement times. The company’s CEO, Devin McGranahan, said this system will provide greater transparency — a major benefit for users in high-inflation economies. Analysts view this as part of Western Union’s broader modernization push, especially after the GENIUS Act clarified digital payment regulations. Competitors like Zelle and MoneyGram are also entering the stablecoin space.

My Take:

This move was long overdue. Western Union has been predatory for years, charging excessive fees to people just trying to send money home. Hopefully, blockchain-based remittances finally push those costs down — but I’m skeptical they’ll pass those savings to users. Let’s see if they actually deliver for the people who need it most.

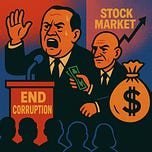

Ro Khanna Proposes Crypto Ownership Ban for Politicians

“Representative Ro Khanna plans a bill banning elected officials from owning and creating cryptocurrencies, calling it a safeguard against crypto corruption.”

Following President Trump’s pardon of Binance founder CZ, Rep. Ro Khanna announced a bill to prevent elected officials from holding or creating cryptocurrencies. The measure builds on earlier efforts to restrict congressional stock trading and aims to address growing concerns about political financial conflicts.

My Take:

A listener asked what I thought about President Trump pardoning CZ.

Here’s my response: CZ’s case is settled — he paid $4 billion in fines and served his sentence. Pardoning him now doesn’t change history or erase what happened. It’s not comparable to preemptive pardons for untried crimes. The real issue is how every administration — red or blue — cozies up to money and power while pretending to fight corruption.

A pardon doesn’t erase that record. What’s more concerning here is the hypocrisy. Ro Khanna, who claims to champion ethics reform, is worth tens of millions, mostly through his wife’s stock trades. It’s disingenuous for him to posture as a crusader against financial conflicts when he benefits from them himself. Both parties — Trump, Biden, Khanna, Pelosi — they’re all too close to the money. The corruption isn’t partisan; it’s systemic.

U.S.–China Trade Deal Boosts Markets

“The United States and China reached a substantial trade framework, likely averting 100% tariffs on Chinese goods.”

Treasury Secretary Scott Besson announced a major trade framework between the U.S. and China, easing tariff tensions and boosting investor sentiment. Bitcoin surged above $114,000, while Ethereum gained over 3%. Analysts credited Trump’s tariff threats for forcing negotiations, with final terms expected at the APEC summit on October 31. Combined with anticipated Federal Reserve rate cuts, this deal could push Bitcoin and gold to new highs as markets respond to easing trade fears.

My Take:

This shows how macroeconomics still drives crypto markets. The easing of trade tensions and expected Fed cuts fuel liquidity — and liquidity always finds its way into Bitcoin first. As global uncertainty fades, we might see BTC test new all-time highs again before year-end.

Market Momentum and Investment Inflows

“Crypto investment products saw $921 million in inflows last week, led by Bitcoin with $931 million.”

Investor confidence has returned following softer-than-expected U.S. inflation data. Bitcoin led the inflows, while Ethereum posted $161 million. However, Solana and XRP saw outflows of $29.4 million and $84.3 million, respectively — a sign that not all altcoins are sharing in the bullish sentiment. The overall tone remains positive, as the market adjusts to expectations of future rate cuts and improving macro conditions.

Crypto Prices

Bitcoin: $115,374 (+0.6%) — Market Cap: $2.3 trillion

Ethereum: $4,150 (–0.2%) — Market Cap: $500 billion

XRP: $2.66 (+1.7%)

BNB: $1,142 (–0.5%)

Solana: $202 (+1.5%)

Dogecoin: $0.201 (–0.4%)

Tron: $0.299 (+0.35%)

Cardano: $0.67 (–0.2%)

HBAR: $0.206 (+16%)

BitTensor: $451.50 (+10%)

MemeCore: $2.21 (+6.6%)

Trump Coin: $7.60 (+22%)

Total Market Cap: $3.89 trillion

Summary

Today’s crypto headlines show a maturing global ecosystem. From Myriad’s expansion into Asia and Japan’s first yen-backed stablecoin to Western Union’s blockchain pilot, the industry continues to merge traditional finance with decentralized technology. On the political side, Ro Khanna’s proposal underscores ongoing tensions between lawmakers and crypto adoption — while trade developments between the U.S. and China remind us that macro trends still shape Bitcoin’s path. Markets remain strong, with inflows surging and BTC holding above $115K as investor optimism builds.

Happy HODLing, Everyone.