Good morning everybody — it’s your Daily Crypto News for Monday, November 10th, 2025. I’m Matt, and I lied. I said I had nothing to ramble about this morning, but that’s never true. Grab your popcorn. Let’s go.

OPENAI IS SHITTING THE BED

OpenAI is having major issues — compute bottlenecks, scaling problems, and a product that’s getting slower by the day. Even the All-In Podcast called out Sam Altman’s recent performance as shaky. He looks like a guy hunting for a bailout, and given how much AI is tied into U.S. GDP growth right now, it’s not out of the question that he’s prepping that angle.

Meanwhile, Elon looks like he played this one right. X.ai might not have the best AI model, but he’s locking down infrastructure and compute early — the real scarce resource in the AI boom.

MY TAKE

This is déjà vu for tech cycles. When compute becomes the bottleneck, the game shifts from innovation to access. OpenAI’s running into the same wall Meta hit in 2019 — the hardware wall. You can’t print GPUs.

THE 41-DAY GOVERNMENT SHUTDOWN AND THE HIDDEN GDP TIME BOMB

The U.S. government shutdown is now on day 41 — and the headlines about “workers missing paychecks” only scratch the surface.

Here’s the bigger story:

The federal government employs 2.2–2.3 million civilians, not counting the military or contractors. Add those in, and you’re pushing 4 million people not getting paid — meaning trillions of dollars in annualized spending velocity is frozen.

That’s not sympathy talk. That’s math. When you shut off payroll for the nation’s largest employer during the holiday booking season — flights, hotels, shopping, travel — you’re talking about a macroeconomic blackout.

Each day adds more lag to GDP, just like COVID’s “missing learning year” flowed through schools for seasons afterward. The same delayed shock is about to hit spending data.

MY TAKE

This is exactly how a “soft landing” turns into a “stalled economy.” When the flow of money stops, GDP doesn’t pause — it decays.

THE SENATE BLINKS — DEAL ON THE HORIZON

Late Sunday, eight Democrats joined Senate Republicans to advance a House-passed short-term funding bill, the first real movement toward ending the shutdown.

After 14 failed votes, the new plan lets leadership fold in three appropriations bills and extend stopgap funding through January instead of November. Democrats get a predetermined vote on extending health-insurance tax credits they’ve long wanted.

It’s not a done deal — but for the first time in 41 days, there’s oxygen in the room.

MY TAKE

Markets will wake up fast if this passes. The moment those paychecks and contracts restart, the velocity of money rebounds — and you’ll see that in crypto liquidity too.

BITWISE SOLANA ETF (BSOL) HITS $445 MILLION

Bitwise’s Solana Staking ETF (BSOL) continues to surprise, pulling in $126 million in its first full week and now sitting at $445 million total inflows since launching October 28.

CEO Hunter Horsley said BSOL has seen inflows every single day for the last eight days — even as Bitcoin and Ethereum ETFs bled billions.

Analysts credit Solana’s active staking community and strong yield model, despite SOL being down nearly 29% on the month.

MY TAKE

If this keeps up, Solana might become the first altcoin with real institutional stickiness. ETFs are the new liquidity rails — and Solana’s winning the PR game.

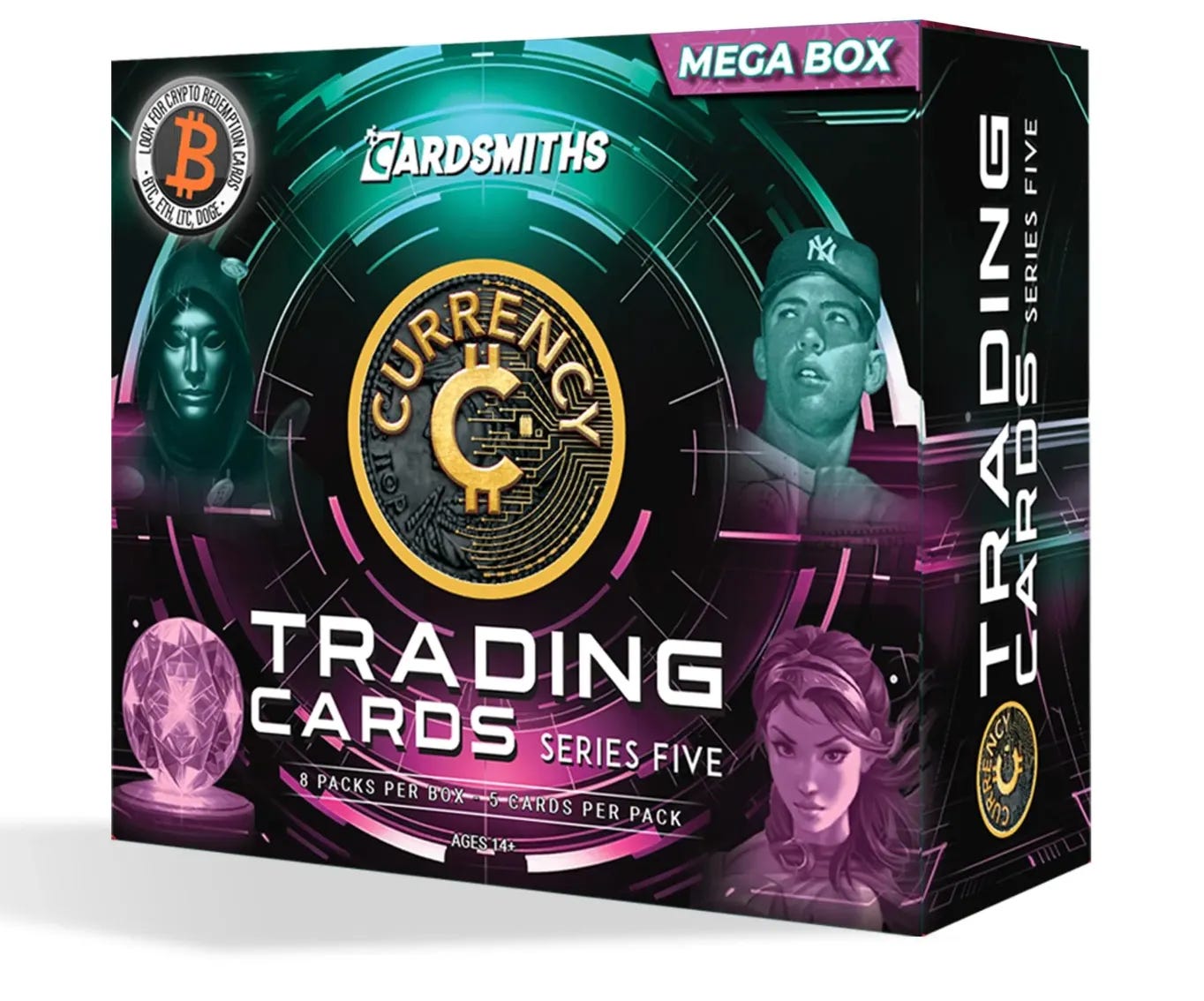

CARDSMITHS LAUNCHES CURRENCY SERIES 5 — WITH BITCOIN INSIDE

Trading card company Cardsmiths launched Currency Series 5, featuring $500,000 worth of crypto prizes and five cards redeemable for a full Bitcoin each.

Each $37 box includes two packs with a 1-in-96 chance of pulling a crypto redemption card for BTC, ETH, DOGE, or LTC via BitPay. CEO Stephen Loney said demand “exceeded all prior releases,” with collaborations from Mr. Brainwashand Gunship Revolution Studios fueling the hype.

MY TAKE

Crypto meets collectibles — again. But this time, it’s got a pull tab. If Topps ever adds Bitcoin to baseball cards, we’re in the final boss phase of adoption.

TRUMP’S WLFI TOKEN SURGES AS SHUTDOWN DEAL NEARS

The World Liberty Financial (WLFI) token — the Trump-backed coin — jumped 29% to $0.158, reaching a $4.2 billion market cap as optimism grows around a potential shutdown resolution.

Investors are also betting on Trump’s proposed “tariff dividend”, a plan to return tariff revenue to U.S. citizens as direct payments. Critics call it “economic populism with a token wrapper,” but the market doesn’t care — it’s up big.

MY TAKE

Trump’s $2,000 tariff dividend idea is political jiu-jitsu. If Democrats fight it, they look like they’re taking money away from Americans. If they don’t, they validate the policy. Either way, WLFI rides the headline wave.

BANK OF ENGLAND MOVES TOWARD STABLECOIN RULES

The Bank of England published its long-awaited consultation on sterling-backed systemic stablecoins, aiming to finalize the framework by late 2026.

Issuers would have to back 40% of reserves with BoE deposits and 60% with short-term U.K. government debt, with holding caps of £20,000 per individual.

The BoE claims the goal is to “balance innovation and stability” as the U.K. enters its digital pound era — but critics say they’re dragging their feet.

MY TAKE

This is the most British approach imaginable: regulate first, move in 18 months, and hope innovation waits politely.

LISTENER COMMENTS

Jason J. Moore writes:

Trump’s tariff dividend is politically brilliant. If it’s blocked, Democrats look like they’re denying people $2,000. If it passes, Trump owns the win. Either way, it’s leverage.

He adds that tariffs will still pass costs down to consumers, and that macro inflation is real-time visible — citing his own furniture order jumping $500 overnight due to “macroeconomic conditions.”

Jason also argues that the top is already in, but says the market isn’t fearful enough or oversold enough yet for a true capitulation.

MY TAKE

Jason’s not wrong about the contradiction — but he nails the psychology. Everyone feels bearish, but not everyone actsbearish. That means there’s still meat left on this move, either way.

CRAIG COBB’S MARKET ANALYSIS

Craig Cobb weighed in with his weekly trader view:

Bitcoin: Still in a daily downtrend — lower highs, lower lows.

$100K remains strong support; $120K would confirm reversal.

Monthly chart still bullish and strong — the long-term structure remains intact.

Ethereum, Solana, BNB, ADA: All still trending down short-term, with possible short setups.

Zcash: Quietly up 18x since August — a reminder that trends can flip fast.

MY TAKE

Craig’s exactly right — the big picture still looks fine. But until the daily charts reverse, don’t expect moon missions. Wait for confirmation, not hopium.

CRYPTO PRICES — 9:39 AM EST

Bitcoin: $105,645 (+2.2%)

Ethereum: $3,580 (+1.5%)

XRP: $2.53 (+10%)

BNB: $994 (flat)

Solana: $167.83 (+3.7%)

Tron: $0.294 (+1%)

Dogecoin: $0.181 (+1.8%)

Cardano: $0.589 (+2.7%)

Total Market Cap: $3.57T (+2.2%)

Bitcoin MC: $2.1T | Ethereum MC: $432.6B

Fear & Greed Index: 29 (Fear)

RSI: 56.2 (leaning overbought)

Big Movers:

Hedera (HBAR): +10.3% at $0.192

World Liberty Financial (WLFI): +30% at $0.158

SUMMARY

OpenAI’s compute chaos adds pressure to tech-led GDP growth. The government shutdown finally shows cracks as a bipartisan funding plan emerges. Bitwise’s Solana ETF keeps pulling inflows, Trump’s WLFI token flies, and the Bank of England continues to regulate in slow motion.

Craig Cobb says we’re still in a short-term downtrend — and the charts back him up. The big question isn’t if the cycle’s over. It’s whether the shutdown ends fast enough to stop a self-inflicted recession.

Happy HODLing, Everyone.

References & Affiliates

🏛️ CBS News: Senate Holds Weekend Session to Avert Government Shutdown

📊 Bitwise Solana ETF Sees Steady Demand as Bitcoin and Ethereum Funds Shed Assets

💳 Cardsmiths Launches Currency Cards Loaded With Bitcoin, Dogecoin, and Ethereum

🚀 Trump-Backed “World Liberty Financial” Token Surges as Senate Moves to End Shutdown

🏦 Bank of England Targets H2 2026 for Final Stablecoin Rules

Self-Custody Crypto Roth IRA:

athenic.xyz

Use Code DCN for $30 off: DCN

Where to Find DCN:

🌐 DailyCryptoNews.net

🐦 twitter.com/DCNDailyCrypto

📈 Trader Cobb on X

🌿 The Grow Me Co

Disclaimer

This content is not financial, legal, or tax advice. It reflects personal opinions for educational and entertainment purposes only.

I am not a financial advisor or expert, and I do not guarantee any specific outcome.

Always do your own research before making any investment or financial decisions.

©Copyright 2025 Matthew Aaron Podcasts LLC

Daily Bitcoin, Ethereum, & Crypto News!