What Is the Benner Chart (and Why Bitcoiners Should Care)?

Why the next six years may matter more than the last six months

WARNING: THIS IS NOT FINANCIAL ADVICE AND YOU SHOULD NOT USE THIS INFORMATION SOLEY TO MAKE A BUYING OR SELL DECISION!!!!!

Executive Summary (TL;DR for skimmers)

2026 is a classic late-cycle year under the Benner model: high optimism, elevated prices, and rising downside risk.

2027–2029 likely represent a prolonged digestion phase: volatility, drawdowns, boredom, and selective opportunity.

2030–2032 increasingly resemble reset and accumulation years, not euphoric blow-offs.

Price upside does not disappear — but returns become uneven and psychology matters more than narratives.

This is not a “Bitcoin is over” thesis.

It is a “Bitcoin changes tempo” thesis.

Quote of the Day

“Markets don’t end when everyone agrees — they end when no one is paying attention.” - The Inspirator

What Is the Benner Chart (and Why Bitcoiners Should Care)?

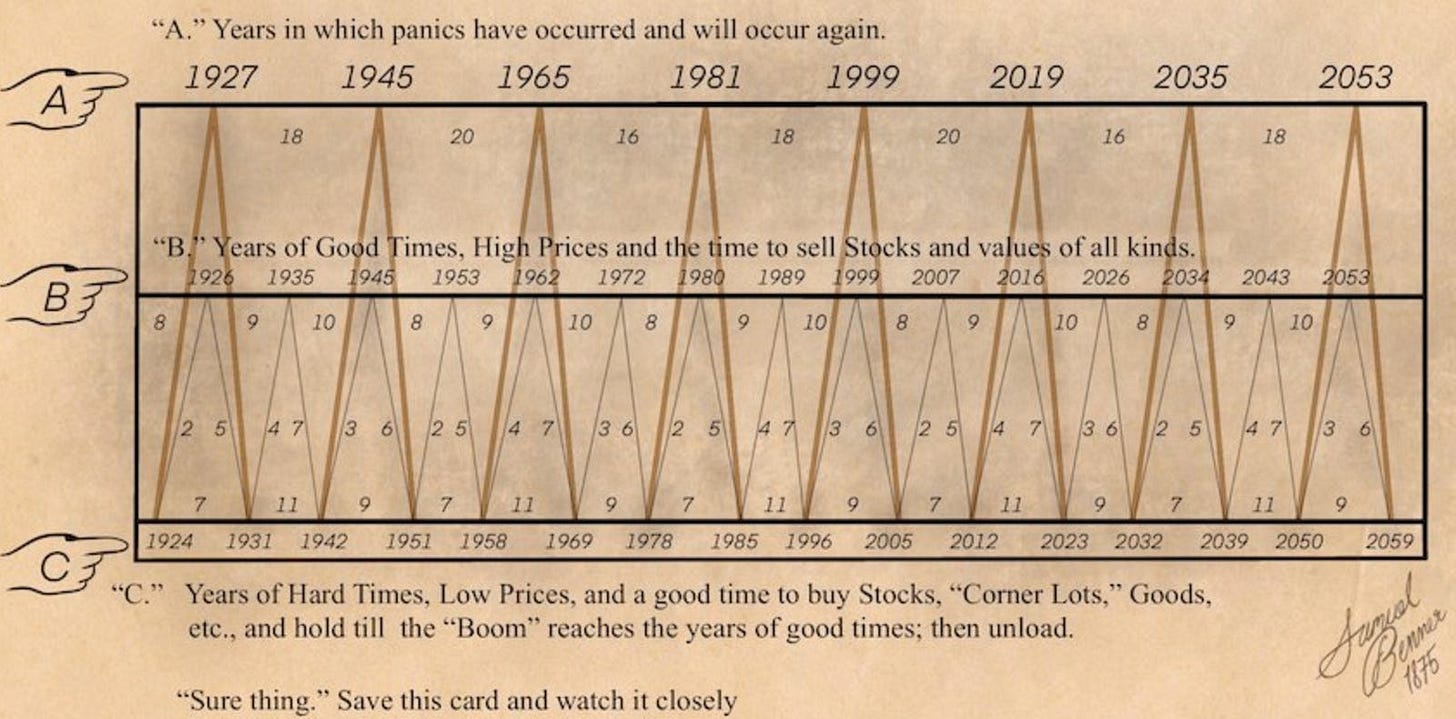

The Benner Chart is an old market map, created in 1875 by Samuel Benner.

It doesn’t predict prices. It tracks how people behave with money.

Benner noticed that markets move in repeating waves:

People get excited and prices go up

Everyone feels confident

Then something breaks

People panic and sell

Markets go quiet

And the cycle starts again

He grouped these waves into three simple phases:

Good Times: Prices are high, news is positive, and everyone feels safe.

Hard Times: Prices stall or fall, markets are boring, and people lose interest.

Panic Times: Fear takes over, prices drop fast, and most people give up.

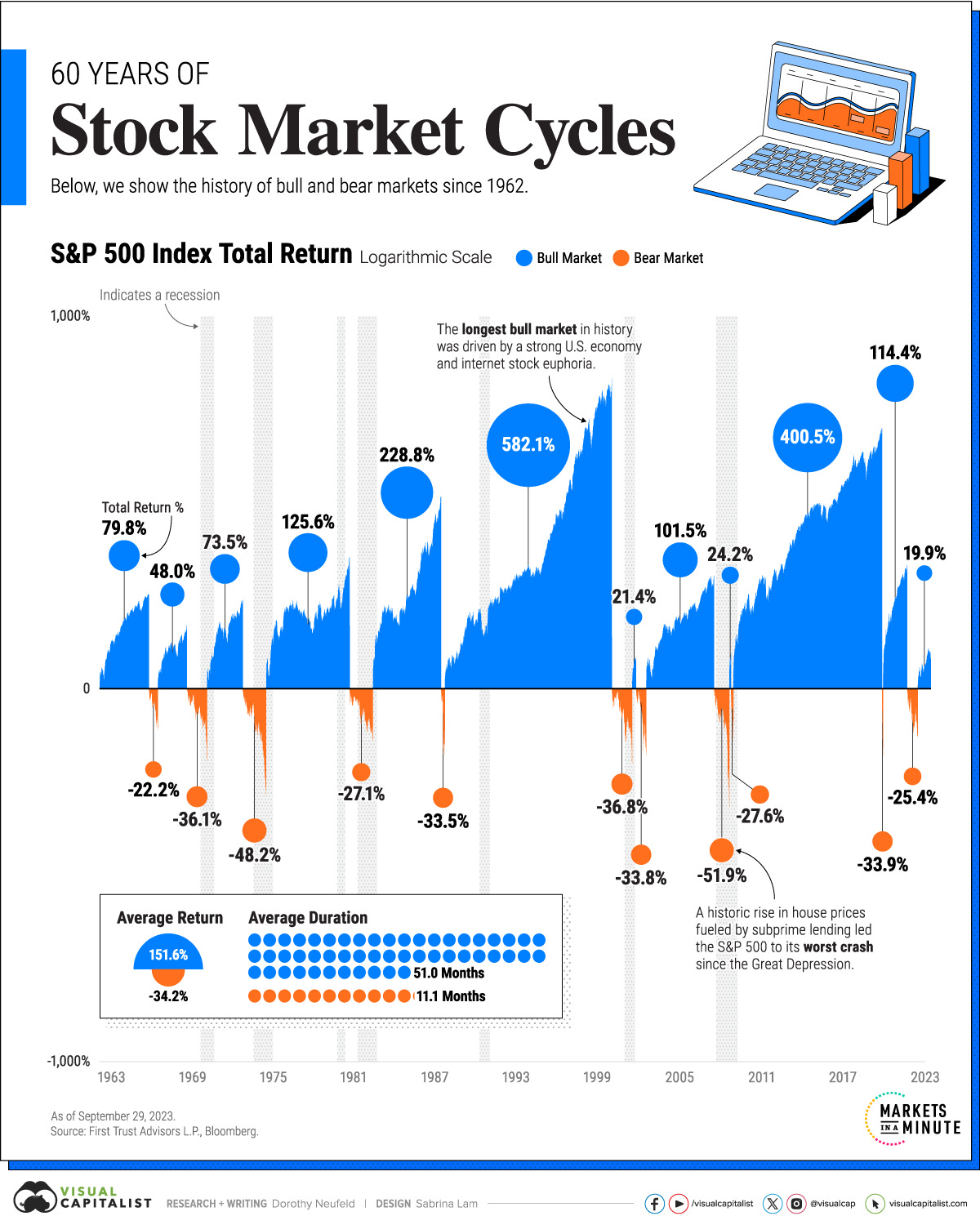

Bitcoin is new — but human behavior is not.

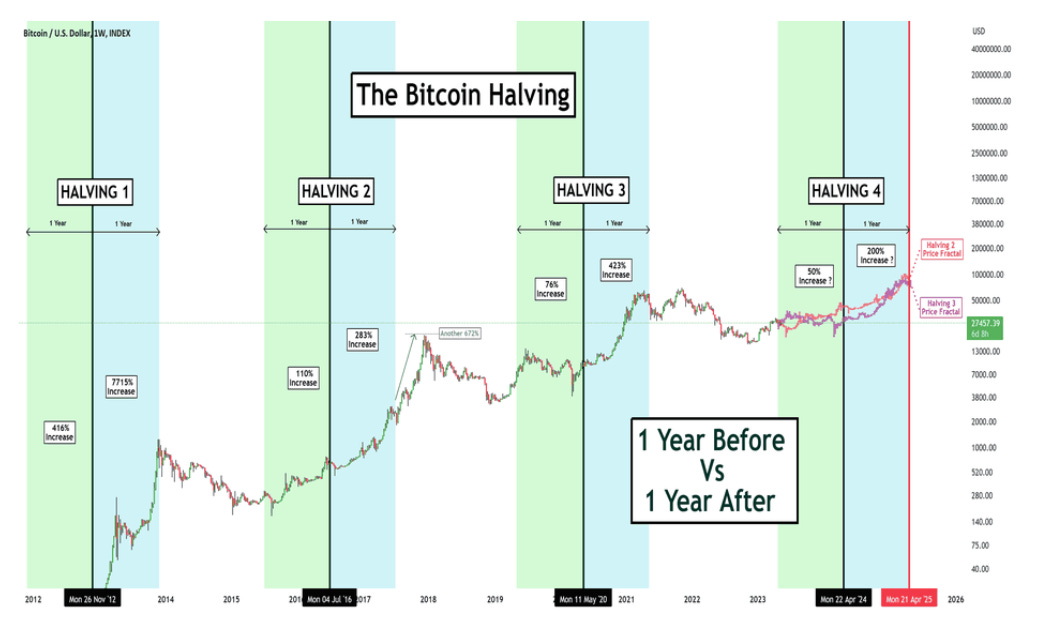

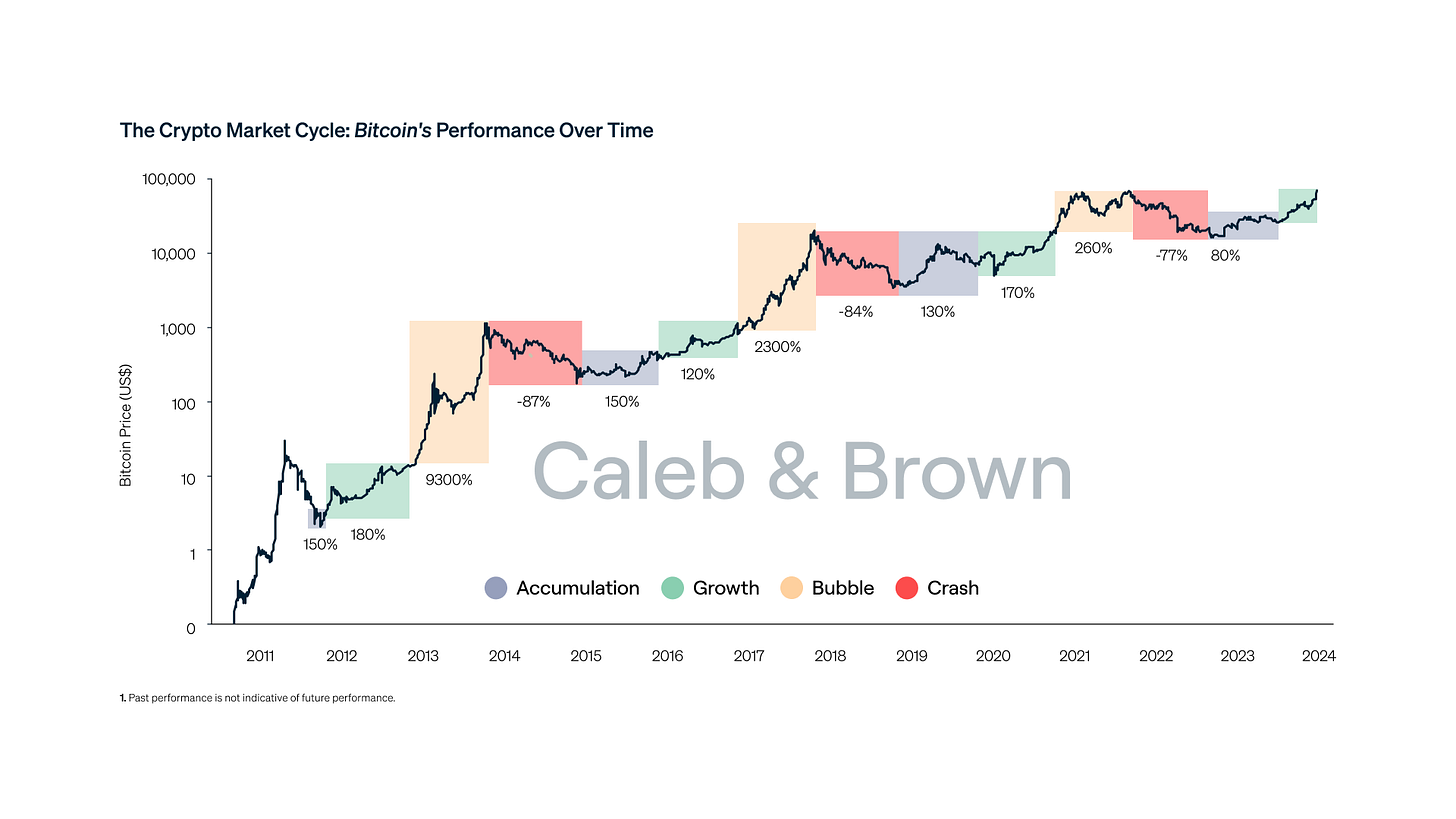

Even though the Benner Chart is over 100 years old, Bitcoin has followed these same emotional patterns:

Big excitement near tops

Long, boring stretches afterward

Scary sell-offs that feel like the end

Quiet years where patient investors build positions

The Benner Chart doesn’t tell us what Bitcoin will do next week.

It helps us understand what kind of year we’re in — and that matters, because doing the right thing in the wrong year often feels wrong.

That’s why the sections below don’t focus on hype or exact prices.

They focus on cycle awareness, risk, and patience — the things that actually matter over time.

The Three Parts of the Benner Cycle

Benner said markets rotate through three moods:

🟢 Good Times

This is when:

Prices are high

Everyone is confident

The news is positive

People say, “This time is different”

These years often feel safe — but they are usually the riskiest.

🟡 Hard Times

This is when:

Prices stop going up

Markets move sideways or down

Fewer people care

The excitement disappears

Nothing dramatic happens — and that’s the problem.

Most people quit paying attention here.

🔴 Panic Times

This is when:

Something breaks

Fear takes over

Prices drop fast

People sell because they’re scared

These moments feel terrible —

but they are often when big opportunities quietly appear.

Why This Matters for Bitcoin

Bitcoin is new.

Human behavior is not.

Even though Benner made this chart over 100 years ago,

Bitcoin has followed these same emotional waves:

Big excitement at the top

Long boring periods after

Panic moments everyone regrets selling into

And quiet years where smart money builds positions

The Benner Chart doesn’t tell us where Bitcoin will go tomorrow.

It helps us understand what kind of year we’re in.

And that matters — because doing the right thing in the wrong year feels wrong.

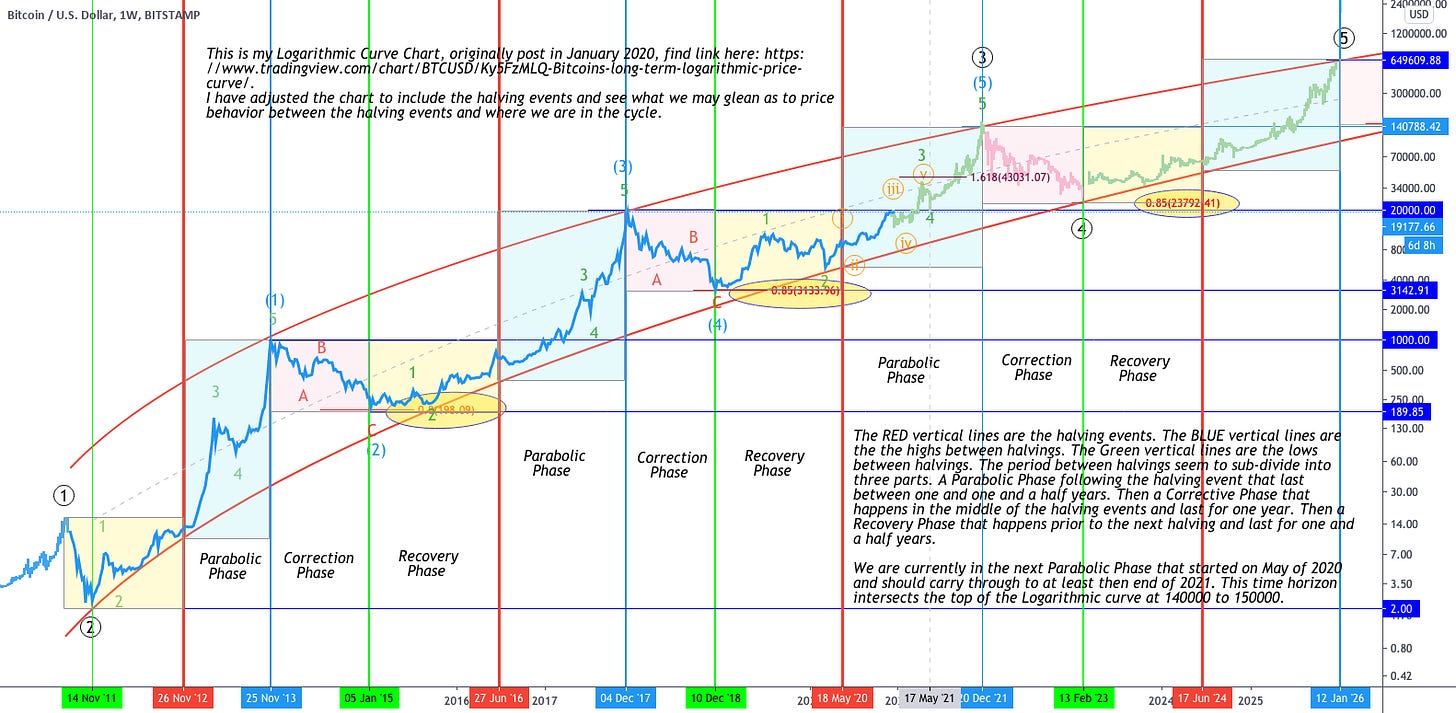

Overlaying Benner with Bitcoin: 2026–2032

2026 — Late Bull / Distribution Risk

Benner Phase: Good Times (B)

Market Character:

Elevated valuations

Strong narratives (ETFs, institutional adoption, treasuries)

Rising leverage and volatility

Bitcoin Reality:

This is not early-cycle Bitcoin. This is post-halving, post-ETF Bitcoin.

Historically, this phase is where:

New highs are possible

Risk becomes asymmetric

Late buyers confuse momentum with safety

Probable Price Range (2026):

Bear case: $70k–$85k

Base case: $90k–$130k

Bull case: $150k–$180k

Probability-weighted expectation favors volatility and distribution, not straight-line gains.

2027 — Digestion & Drawdown

Benner Phase: Transition toward Hard Times

Market Character:

Narrative fatigue

Reduced liquidity

“Bitcoin is broken again” discourse

Bitcoin Reality:

Every prior cycle had a year like this.

Probable Price Range (2027):

Bear case: $45k–$60k

Base case: $60k–$85k

Bull case: $100k (failed retests likely)

This is typically a psychologically brutal year, even if structurally healthy.

2028 — Tension Year (Benner vs Halving)

Benner Phase: Hard Times

Bitcoin Event: Halving year

This is where models conflict.

Benner suggests caution

Bitcoin’s supply mechanics improve

What usually happens:

Sideways-to-up bias

Violent shakeouts

Accumulation disguised as boredom

Probable Price Range (2028):

Bear case: $55k–$70k

Base case: $70k–$100k

Bull case: $120k

2029 — Expansion Attempt

Benner Phase: Hard Times

Bitcoin Reality: Post-halving momentum tries to assert itself

This year determines whether Bitcoin:

Breaks decisively higher

Or remains capped by macro liquidity constraints

Probable Price Range (2029):

Bear case: $65k–$85k

Base case: $90k–$140k

Bull case: $180k–$220k

High dispersion. Expect disagreement. Expect volatility.

2030 — Fragility or Continuation

Benner Phase: Hard Times

If 2029 ran hard, 2030 often disappoints.

If 2029 stalled, 2030 can surprise.

Probable Price Range (2030):

Bear case: $60k–$80k

Base case: $80k–$120k

Bull case: $160k

2031–2032 — Reset & Re-Accumulation

Benner Phase: Hard Times (explicitly low-price favorable years)

These are typically:

Quiet years

Low engagement years

Builder and allocator years

Historically, this is when future winners are positioned.

Probable Price Range (2031–2032):

Bear case: $50k–$70k

Base case: $70k–$100k

Bull case: $120k–$150k

This period increasingly sets up the next major Bitcoin expansion beyond 2032–2034.

Question of the Day

If Bitcoin traded sideways for five years but doubled afterward, would you still hold — or would boredom beat conviction?

The Big Idea

Markets don’t fool people with math.

They fool people with feelings.

The Benner Chart is just a reminder:

If you can stay calm when others are excited

and stay patient when others are bored

you already have an edge.

What This Means for Investors (Plain English)

2026: Manage risk. Do not confuse adoption with inevitability.

2027–2029: Patience beats prediction. Consistency beats conviction.

2030–2032: These are likely remembered as “missed years” by those who quit paying attention.

Bitcoin has never rewarded maximum enthusiasm.

It has always rewarded maximum endurance.