Good morning everyone – did you miss me? I’m back in the studio after Kyle's episode yesterday (and yes, I heard your feedback on the music). We've got a hefty show today: executive orders, Epstein, ATM scams, lost Bitcoin revenge, mining hash rates, and even how to buy citizenship with crypto.

Let’s get into it.

🇺🇸 Trump Signs Executive Order to Stop 'Debanking' of Crypto Firms

🚨 FinCEN Warns Bitcoin ATMs Being Used in Growing Number of Scams

🗑️ Man Who Lost $923M in Landfill Bitcoin Fails to Buy Dump — Here's His New Plan

🏦 Ethereum Sees Billions in Institutional Buys as Retail Remains on Sidelines

🌍 Four Countries Now Let You Buy Citizenship or Golden Visas with Crypto

📉 Trader Cobb & Market Training via The Grow Me Co

🇺🇸 Trump’s Executive Order on Crypto Debanking

President Trump is prepping an executive order to stop what he calls politically motivated debanking of crypto firms and conservative groups. The draft would direct regulators to investigate whether banks violated antitrust or consumer protection laws when closing customer accounts. It's aimed squarely at what critics call “Operation Chokepoint 2.0” — a Biden-era effort to pressure banks into dropping politically disfavored clients.

Now, I’ve got a lot to say here. Banks have always discriminated. We’ve seen it with race, gender, marital status — and now, politics and business type. I've known people in crypto media who’ve been debanked just because they took ad money from exchanges. One day you're running a legal business, the next you get a check in the mail with your balance and a "good luck."

Look, I get it — private companies should choose their clients. But when banking becomes political punishment, especially for legal activity, we’ve got a problem. There needs to be equal rights to banking. This isn’t theoretical — it’s real, and it’s happening.

🧩 Listener Question: Epstein, the Files, and Broken Trust

Will wrote in asking about the Epstein case and whether the files should be released. Here's my take:

Yes. All of it. Release everything.

I don’t care who it implicates — CIA, Mossad, MI6, billionaires, whoever — it’s time to expose it. If Epstein was a tool for intelligence agencies to coerce or manipulate people, the public deserves the truth. I’ve watched a lot of podcasts on this, and the more I dig, the clearer it becomes — the underage sex trafficking is probably just the depraved tip of the iceberg.

This might’ve been a safe house for intelligence operations, a place where conversations were bugged, deals were made, and leverage was collected. Cheating on your wife, money laundering, shady politics — it’s all leverage. The underage stuff was just what shocked us. And if that was done with taxpayer money? If that’s the compromise? Then this whole system is morally bankrupt.

We’re seeing it everywhere: taxes weaponized, laws unevenly applied, elites skirting accountability. Globally. People are waking up. And they’re asking: when does this stop, and what do we do about it?

🚨 FinCEN Bitcoin ATM Scam Warning + Beekeeper Justice

FinCEN just warned that Bitcoin ATM scams caused $247 million in losses last year. Most victims? The elderly. These scammers pretend to be tech support or government officials, then guide people step-by-step to local kiosks to send crypto.

These machines? Many aren’t even properly registered. Some charge up to 25% in fees, and advertise “anonymity” — skipping all KYC. It’s privacy theater until the old lady loses her life savings.

If you haven’t seen The Beekeeper (spoiler alert), Jason Statham plays an ex-CIA beekeeper whose friend gets scammed and kills herself. He goes out and kills everyone responsible. Honestly? I’m for it. Justice.

That said, I'm torn. I believe in privacy. I believe people should be able to transact freely. But these kiosks are being used to fraud old people? Chicago has 1,100 of them. Criminals use them to launder cash, swap stablecoins, and chain-hop across blockchains.

New Zealand wants a full ban. Australia’s cracked down. Spokane, Washington banned them. (Yes, Spokane made the list.) The point is: there’s a balance between privacy and abuse. Let me know your thoughts.

🪙 James Howells’ Lost Bitcoin Becomes Layer 2 Revenge

This is one of my favorite crypto stories ever.

James Howells — the Welshman who lost 8,000 BTC in a landfill (now worth $923M) — is finally giving up the dig. But he’s not quitting. He’s launching a Bitcoin Layer 2 network called Ceneiog (Welsh for “penny”), and it’ll be backed by his inaccessible Bitcoin.

Why is that genius? Because you can verify the coins are still there and untouched. Courts already acknowledged his ownership. It’s like having a burn-backed token. He’s using this tech pivot as revenge against the Newport City Council that blocked him from excavating the landfill. His quote:

“I’ll tokenize it, create a load of money, and ram crypto down your fucking throat for the rest of your life.”

I love that.

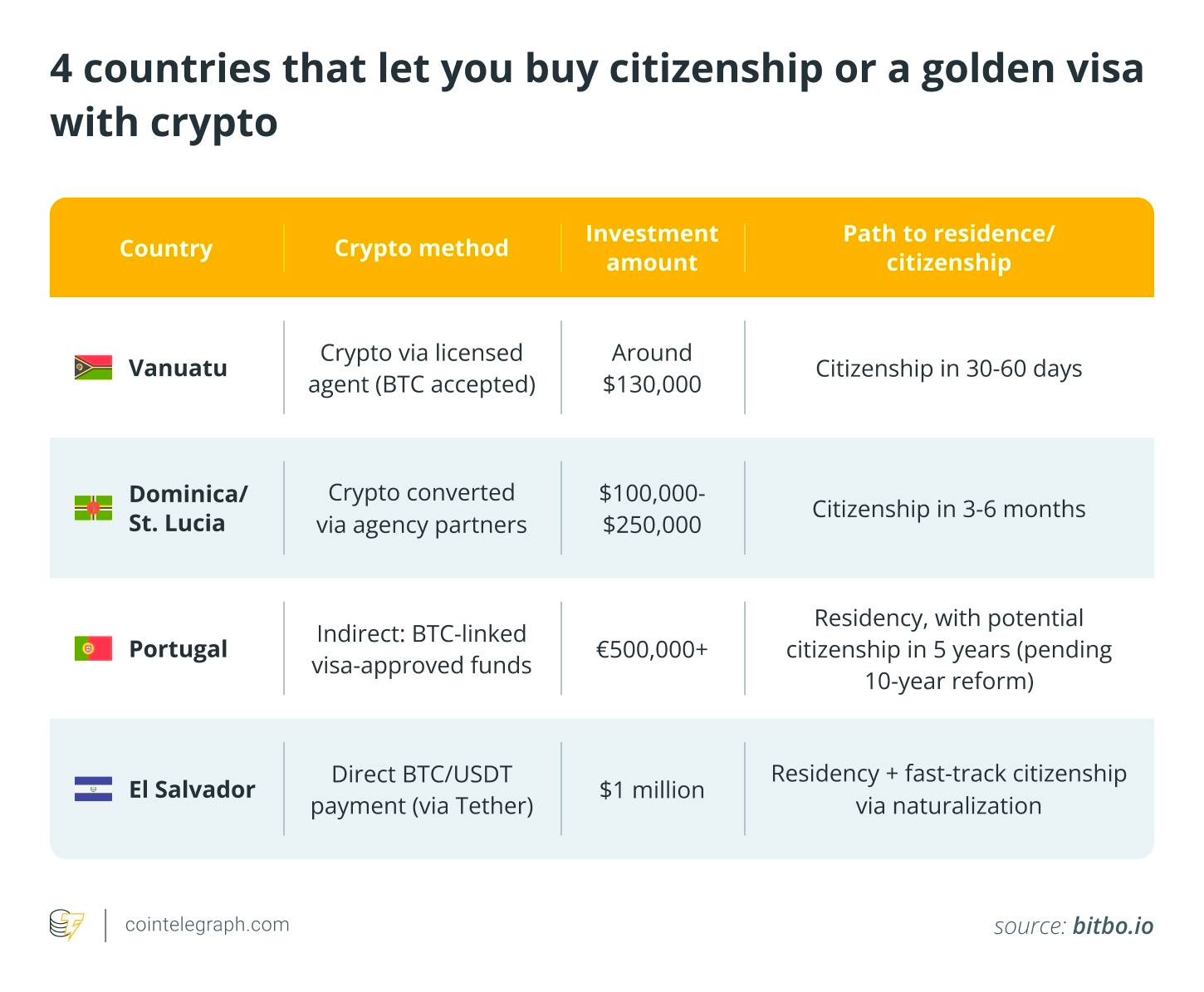

🌍 Buying Citizenship With Crypto

If you’ve got crypto and want a second passport, here are your 2025 options:

Vanuatu: $130K in crypto or stablecoins gets you a passport. Fully remote.

St. Lucia: $200K–$300K donation = citizenship in under 9 months.

Portugal: No crypto directly, but invest €500K into a fund (converted from crypto) and get an EU Golden Visa. No stay requirements. Citizenship possible in 5–10 years.

El Salvador: OG status. $1M via Tether gets you their “Freedom Visa.”

Kazakhstan: $300K fiat-only golden visa.

St. Kitts: No investment needed — just prove crypto-based wealth.

Most of these require KYC and AML, but if you’re serious about an escape hatch, the path exists

.

⛏️ Guest Segment: Hashrate and Bitcoin Mining, Explained

Charley Brady (VP of Investor Relations, Bitfufu) joined us to break down how hashrate works:

“Each hash is a guess at solving Bitcoin’s cryptographic puzzle. The more guesses per second, the better your chance of winning the next block and getting 3.125 BTC. Hashrate also secures the network — the more total hashpower, the harder it is to attack Bitcoin.”

As of June 30th, Bitfufu runs at 36.2 EH/s — that’s 36.2 quintillion guesses per second, accounting for 4% of the global network. Global hashrate: 944 EH/s. Bitcoin self-adjusts difficulty every 2 weeks to maintain 10-minute block times. It’s a self-regulating machine.

📊 Market Wrap – August 5, 2025 @ 9:00 AM EST

Fear & Greed Index: 55 (Neutral)

BTC: $114,053 (▼ 0.3%)

ETH: $3,634 (▲ 1.7%)

XRP: $3.03 (▲ 1.1%)

BNB: $759 (▲ 0.3%)

Solana: $167 (▲ 2.5%)

Tron: $0.332 (▲ 0.6%)

Dogecoin: $0.204 (▲ 1.2%)

Cardano: $0.741 (▲ 0.1%)

Total Market Cap: $3.73T (▲ 0.25%)

BTC Market Cap: $2.26T

ETH Market Cap: $438.4B

🎙️ Shout-Out

Big thank you to Ohio Housing Nerd on YouTube. He helped me understand the housing market in Ohio (and nationally) through DM convos and live shows. His videos are super insightful — links in the show notes.

🔚 Final Notes

We're collaborating with Blockworks and expanding our Substack with new voices. Check out dailycryptonews.net and stay connected.

Until next time —

Happy HODLing, everyone.