Quick hit show today: Circle flips on gun purchases, a wild “lost BTC” court case, Australia’s tokenization wake-up call, a new U.S. crypto tax push, Robinhood’s monster quarter, Paul’s $106K pivot, and spicy Polymarket odds. Let’s rip.

CIRCLE UNBANS GUN-RELATED USDC TRANSACTIONS

Circle reversed its ban on firearm-related purchases, telling NSSF it won’t block Second Amendment–protected commerce. Supporters call it a win against financial censorship; critics say it shows how centralized stablecoins can be steered by politics and policy pressure.

MY TAKE

If a company can flip a switch on what you’re “allowed” to buy, that’s the centralization risk in one screenshot. It shouldn’t have been banned to begin with.

COURT REJECTS $354M “LOST BITCOIN” CLAIM

A U.S. appeals court tossed Florida man Michael Prime’s bid to recoup BTC allegedly on drives destroyed after a 2019 case, citing delay and his earlier denial of owning crypto. With an estimated 2.3–4.0M BTC gone forever, scarcity narrative tightens.

MY TAKE

Brutal. If he hid it, he risked forfeiting it. If it never existed, the court dodged a windfall. Property handling by authorities still deserves scrutiny.

AUSTRALIA WARNED: TOKENIZATION TRAIN IS LEAVING

ASIC’s chair says local institutions are “too comfortable” while global players (e.g., JPM) push ahead on tokenized funds. Industry leaders urge action now, not “wait for perfect regs,” or capital and talent head offshore.

MY TAKE

The window where “pilot” beats “paralysis” is closing. Custody, disclosure, and rails are shippable today—use them or lose the market.

MAX MILLER FLOATS BIPARTISAN CRYPTO TAX BILL

Rep. Max Miller (R-OH) and Rep. Steven Horsford (D-NV) are prepping a bill to clarify digital-asset taxation: de minimis exemptions for small spends, standards for airdrops/lending, and a broader framework alongside stablecoin rules.

MY TAKE

“Revenue-generating” is doing a lot of work here. Clarity is good; new carve-out taxes disguised as clarity are not. Show the thresholds and mechanics.

ROBINHOOD PRINTS A MONSTER QUARTER

Q3 revenue hit ~$1.2B with ~$556M profit as crypto trading surged and RH banking/prediction markets grew. Stock is up big YTD, leadership shuffle announced, and bulls lifted targets.

MY TAKE

Love them or hate them, they keep capturing the retail on-ramp. If ETFs made BTC “respectable,” RH has made trading “ambient.”

THE INSPIRATOR’S PIVOT LEVEL: $106K

Paul’s read: October’s dip didn’t end the cycle. Accumulation is strong (375K BTC in 30 days; 50K on Tuesday’s flush). Hold $106K and a run back to $112–$115K (maybe ATHs later) is in play; lose it and expect sub-$100K chop into a Santa-rally attempt. 2026 looks likelier for $130K.

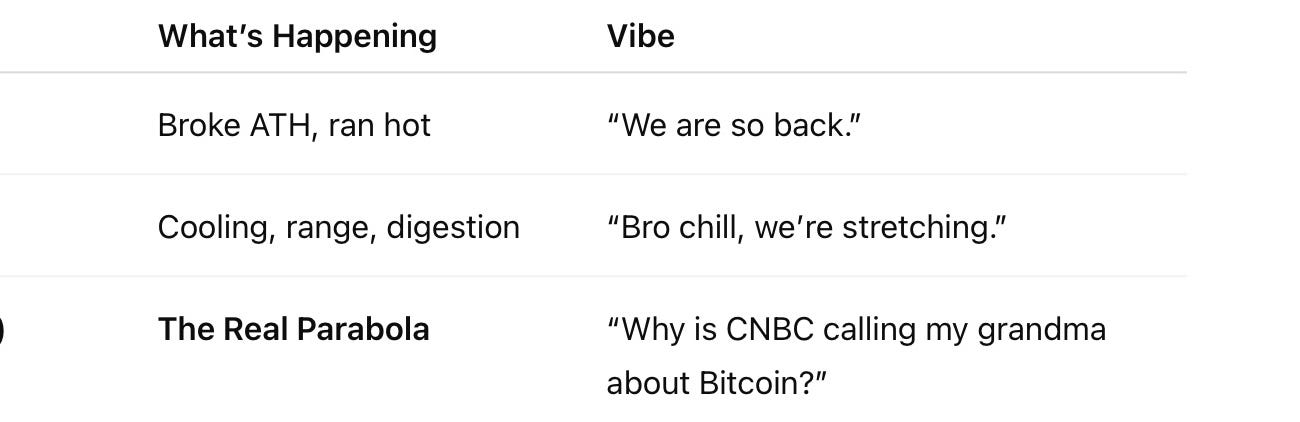

🎢 Bitcoin: The “Calm Down, We’re Still Early” Market Update

Guess what day it is? C’mon guess what day - it - is. HUMPDAY YEAH! Still on travel and busier than ever but given the market movements I figure I should put my thoughts out so I don’t have to respond to everyone individually. Remember folks, these are MY thoughts on the market and it’s NOT FINANCIAL ADVICE. Just as I give the predictors crap, I’d be ec…

MY TAKE

I don’t buy “cycle over” yet. ETFs, policy, and tokenization flows changed the market’s spine. Respect risk, but keep powder for key level reclaims.

POLYMARKET WATCH: BIG ODDS, BIG TEMPTATION

BTC in November: Buckets split; tails pay huge if we rip or slip.

Gov’t Shutdown End Date: Fat payouts only on unlikely near-term reopen windows.

Fed Cut Size: 25 bps is base case; outliers pay lotto-style multiples.

MY TAKE

If insiders can influence outcomes, some markets aren’t markets—they’re carnival games. Price the manipulation risk—or don’t play.

LISTENER MAIL

“Paper BTC at Binance?” — Jason

That claim means the exchange allegedly sells more BTC claims than spot held, pressuring price. If true, it’s structural sell pressure and a redemption risk.

“Alt rotators into shutdown bets” — Skyler

Yes, “easy money” often pays pennies. The big tickets are the crazy-low probability tails—because they’re crazy.

“Hodling & BTFD” — Jay Yoder

Respect. Keep a plan, not just vibes.

PRICES (10:01 a.m. ET)

Bitcoin: $102,037 (–1.0% 24h; –1.2% 1h)

Ethereum: $3,327 (–0.5% 24h; –1.9% 1h)

XRP: $2.25 (–2.0% 1h)

BNB: $937 (–1.2% 1h)

Solana: $157 (–2.2% 1h)

Tron: $0.283 (–1.5% 1h)

Dogecoin: $0.160 (–1.7% 1h; –3.0% 24h)

Cardano: $0.520 (–2.0% 1h; –2.6% 24h)

Total Market Cap: $3.4T (–0.9% 24h)

BTC MC: ~$2.0T | ETH MC: ~$402B

SUMMARY

Circle’s flip spotlights stablecoin control levers. Court shuts down a massive “lost BTC” claim. Australia gets the tokenization wake-up. A U.S. tax bill could bring clarity—or just new taxes. Robinhood crushes Q3. Paul’s $106K pivot rules the week. Polymarket odds are spicy—but mind the carnival games.

Happy HODLing, Everyone.

References & Affiliates

📰 Daily Crypto News: Bitcoin — The Calm Down, We’re Still Early

🔫 Circle Updates Terms of Service to Allow Legal Firearm Purchases With USDC

⚖️ Appeals Court Rejects Lawsuit Over Alleged $354M Bitcoin Loss

🇦🇺 ASIC Chief Warns Australia Risks Losing Edge as Global Markets Embrace Tokenization

📈 Robinhood Q3 Earnings Beat Expectations as Crypto Revenue Surges

Self-Custody Crypto Roth IRA:

athenic.xyz

Use Code DCN for $30 off: DCN

Where to Find DCN:

🌐 DailyCryptoNews.net

🐦 twitter.com/DCNDailyCrypto

📈 Trader Cobb on X

🌿 The Grow Me Co

Disclaimer

This content is not financial, legal, or tax advice. It reflects personal opinions for educational and entertainment purposes only.

I am not a financial advisor or expert, and I do not guarantee any specific outcome.

Always do your own research before making any investment or financial decisions.

©Copyright 2025 Matthew Aaron Podcasts LLC

Daily Bitcoin, Ethereum, & Crypto News!