What’s up, everyone-- this is your Daily Crypto News for December 3rd. It’s Wednesday. I’m Quile once again here — big days all the time in crypto… Never a dull day.

Today’s HEADLINES for December 3

UK Passes Landmark Law Formally Recognizing Crypto as Property

Liquidity Regime Flips: Fed Ends QT as JPMorgan, Vanguard, and Bank of America All Move Into Crypto

Aave DAO Considers Rolling Back Its Multichain Expansion

Polymarket Begins U.S. App Rollout, Starting With Sports Markets

$1B Legal AI Platform Exposed 100,000+ Confidential Files After Researcher Reverse Engineered Its Core Systems

Some show updates: Matt and I are thinking of reshaping some aspects of DCN to make it more provocative and bring in some more outside voices. We’re thinking about debuting this stuff in January. Stay tuned. We might do a slight rebrand as well. Who knows.

Also, check out our interview with Allora Network yesterday. We dove into some fun AI topics, around agents, open-source maximalism, and the uncanny valley. Check it out.

Some listener comments: Obsidian thinks that quiet accumulation is the way to go for crypto buyers. DCA baby, DCA.

As the ref on Celebrity Deathmatch says--Let’s get it on.

LEZZGO BEYOND THE HEADLINES

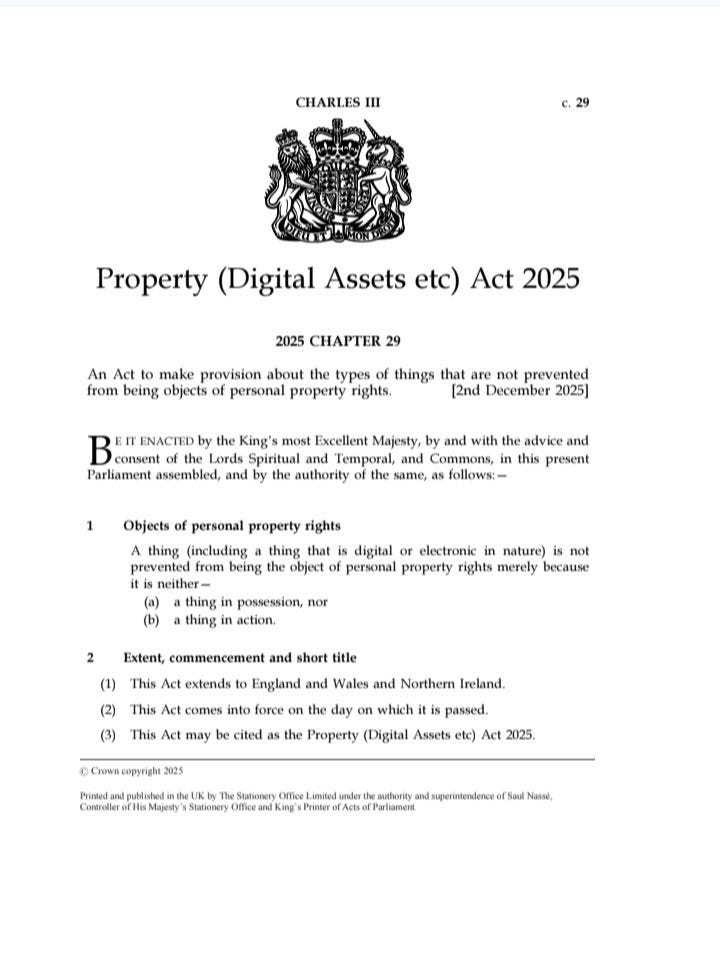

UK Passes Landmark Law Formally Recognizing Crypto as Property

The UK Parliament officially created a new category of property specifically for crypto, tokenized assets, and digital rights.

This provides a clear framework for ownership, recovery, liens, lending, and insolvency—something courts struggled with for years.

Regulators say the move aligns the UK with its broader digital finance agenda, including the tokenized bank deposit trials running into 2026.

Legal experts note this will significantly expand institutional participation, especially from traditional finance custodians.

The UK is positioning itself as the premier Western jurisdiction for tokenized RWAs and stablecoin oversight.

Liquidity Regime Flips: Fed Ends QT as JPMorgan, Vanguard, and Bank of America All Move Into Crypto

The Federal Reserve officially ended Quantitative Tightening, halting two years of balance-sheet runoff and marking a decisive shift toward a more accommodative liquidity regime.

QT reductions historically precede risk-on cycles, and with Bitcoin already behaving as a leading liquidity proxy, JPMorgan now tracks BTC as a signal that front-runs equities during macro shifts.

As liquidity improves, Vanguard quietly unlocked access to spot crypto ETFs after years of blocking them — a full reversal driven by massive client demand for BTC/ETH exposure.

Bank of America issued its first-ever crypto allocation guidance, recommending 4% exposure on the basis that blockchain assets now boost Sharpe ratios and diversify liquidity cycles.

Together, the QT shutdown and Wall Street’s pivot form the strongest macro alignment crypto has ever seen — positioning 2026 as a potential expansion year for BTC, RWAs, DeFi yields, and ETF flows across institutional portfolios.

Aave DAO Considers Rolling Back Its Multichain Expansion

Aave DAO is formally debating whether to deprecate its deployments on zkSync, Metis, and Soneium due to thin liquidity and low traction.

Core contributors argue these chains fragment liquidity, increase oracle + governance risk, and produce minimal revenue relative to upkeep.

Several markets on these chains have failed to reach sustainable borrowing/lending volumes, limiting organic growth.

The proposal marks a clear shift from the 2021–2023 playbook of “deploy everywhere” to a tighter, deeper-liquidity footprint.If approved, Aave would refocus on Ethereum, Base, Arbitrum, and Optimism — the ecosystems with consistent user activity and reliable fee generation.

Polymarket Begins U.S. App Rollout, Starting With Sports Markets

Polymarket began rolling out its U.S.-compliant app to waitlisted users, starting with sports prediction markets as the initial legal foothold.

The app is designed around U.S. regulatory constraints, meaning it excludes political and certain event markets for now — a notable shift from its global platform. Sports markets allow

Polymarket to enter the U.S. via a lightly regulated vertical with massive mainstream demand, mirroring the DFS → sportsbook evolution.

This marks the first step of a broader plan to bring crypto-native prediction markets into everyday U.S. consumer apps, something no major competitor has achieved at scale.

Combined with Kalshi’s new CNN partnership, the U.S. is quietly forming a regulated prediction-market stack, bringing on-chain forecasting into the mainstream.

$1B Legal AI Platform Exposed 100,000+ Confidential Files After Researcher Reverse Engineered Its Core Systems

Alex Schapiro, a security researcher, uncovered that a $1B-valued legal AI platform accidentally exposed 100,000+ confidential legal documents after he reverse-engineered its backend.

The exposed data included case files, contracts, evidence packets, privileged notes, and internal law-firm materials — a catastrophic failure for software meant to secure legal workflows.

The vulnerability allowed unauthorized parties to access documents simply by iterating predictable URLs and authentication tokens — no hacking tools or credentials required.

The discovery highlights the growing risk of AI SaaS platforms becoming central attack vectors, especially in industries dealing with sensitive and regulated information.

Analysts warn that if legal AI tools can leak privileged documents this easily, similar risks apply to AI trading bots, DeFi automation tools, RWA platforms, and institutional crypto processors.

Little BITZ

Circle launches the Circle Foundation, a nonprofit focused on standards, education, and public-good infrastructure for global digital money.

Uniswap integrates Revolut, enabling seamless fiat → crypto onramps for 40M+ users directly inside the DEX interface.

MetaMask releases Transaction Shield, a built-in protection layer that flags malicious addresses and phishing signatures before users sign transactions.

Tether Prints Another $1 Billion in New USDT as Liquidity Wave Builds

Again, check out the Allora interview. Check out Trends with Benefits. Let’s go. See ya folks.

WHERE TO FIND DCN

EMAIL or FOLLOW the Hosts

Quile

Email: kyle@dailycryptonews.net

X: @CryptoQuile

Adam

X: @AtomLion35

——————————————————————

***NOT FINANCIAL, LEGAL, OR TAX ADVICE! JUST OPINION! WE ARE NOT EXPERTS! WE DO NOT GUARANTEE A PARTICULAR OUTCOME. WE HAVE NO INSIDE KNOWLEDGE! YOU NEED TO DO YOUR OWN RESEARCH AND MAKE YOUR OWN DECISIONS! THIS IS JUST EDUCATION & ENTERTAINM