Here are the headlines for today, November 13, 2025

What’s up everyone, welcome to Daily Crypto News for November 13th. It’s Thursday. I’m Quile again here. Only one show today lmao. We gave you a two-fer yesterday.

In macro news, Congress managed to avoid a government shutdown with a last-minute funding deal, keeping markets relatively stable heading into the weekend.

On the crypto side, we’re seeing continued institutional momentum - the Czech National Bank became the first central bank to buy Bitcoin, Singapore’s rolling out stablecoin regulations, and Tether’s building out a gold trading operation.

We also have a messy situation on Hyperliquid, where a manipulator caused $63 million in liquidations, and SharpLink Gaming posted quarterly results from its Ethereum treasury strategy.

As they say in Celebrity Deathmatch - Let’s get into it.

Thursday’s HEADLINES for November 13

Czech Central Bank buys Bitcoin (first central bank ever)

Tether’s gold empire ($12B+ holdings, hiring HSBC traders)

Singapore stablecoin regulations + CBDC trials

Hyperliquid flash crash ($63M in POPCAT liquidations)

Bitfarms Exits Bitcoin Mining for AI Data Centers

Let’s get to some listener comments:

This one is from Matt: “HEY KYLE, Don’t record when you said you wouldn’t. Can you do this show today, though?” My crazy self forgot which day it was. You can probably tell how busy I have been.

And later we’re gonna have Luke Hajdukiewicz, Chief Growth Officer, at Blueprint Finance talk about stablecoins in the UK and how certain policies are limiting the growth of digital asset usage.

Remember to subscribe on Substack, leave a comment on Spotify, like and subscribe wherever you are listening. We love the feedback and really enjoy it. Like, even the Bill Simmons show is bringing back a mailbag. Feedback makes this whole thing super fun, folks.

BEYOND THE HEADLINES

Czech Central Bank Makes History - First to Buy Bitcoin

The Czech National Bank became the first central bank in the world to purchase Bitcoin as part of a “test portfolio” for digital assets, marking a legitimately historic moment for institutional crypto adoption

While they haven’t disclosed the amount, they’re framing it as an experiment in portfolio diversification rather than a full strategic reserve play, coming at a time when countries from Taiwan to the U.S. are discussing similar moves

When a central bank whose entire job is managing national monetary policy decides Bitcoin deserves a spot in their portfolio, every other central bank will be asking themselves if they want to be early or late to this party - MicroStrategy started the corporate playbook, El Salvador wrote the nation-state playbook, and now the Czech National Bank just opened the central bank playbook

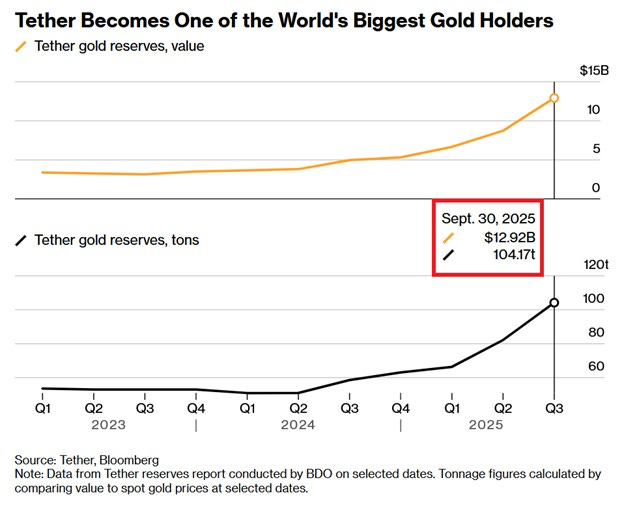

Tether Goes Full Gold Bull - Hiring HSBC Traders

According to the Financial Times, Tether has been hiring senior gold traders from HSBC and now sits on over $12 billion in gold holdings, adding metal at a rate of more than 1 ton per week as of September

The company pulled in $13 billion from reserve assets last year and expects $15 billion in 2025, while reports say they’ve explored investing across the entire gold supply chain from mining to refining and trading

Tether is basically saying backing the world’s biggest stablecoin isn’t enough - they’re building a commodities trading powerhouse, and when you make $15 billion a year you start looking at the entire gold supply chain and thinking “yeah, we could just own that”

Singapore Rolls Out Stablecoin Framework + CBDC Trials

Singapore’s Monetary Authority (MAS) announced they’re rolling out comprehensive stablecoin regulations while simultaneously running trials for tokenized government bills that will be settled using CBDC infrastructure

Singapore has consistently positioned itself as the most crypto-friendly major financial hub in Asia, creating clear regulatory frameworks while the U.S. is still fumbling around trying to figure out its stablecoin approach

This is how you win the race for crypto capital - you don’t ban things and wonder why innovation happens somewhere else, you create smart regulations and become the destination for serious projects, and every stablecoin issuer is looking at this thinking about relocating to Singapore

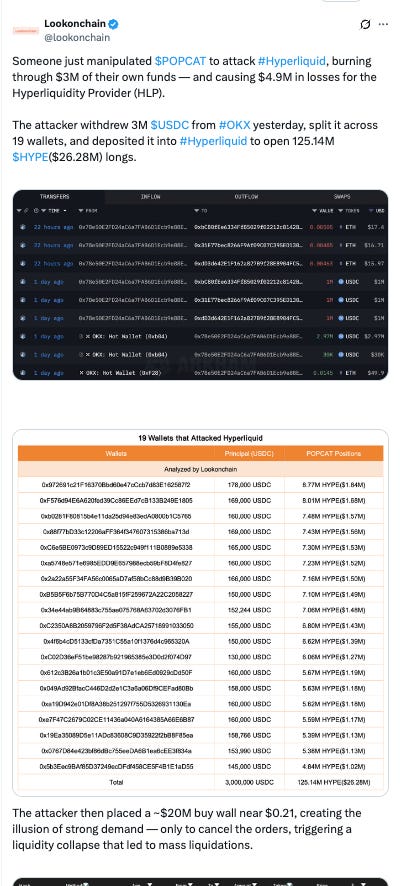

Hyperliquid Flash Crash - $63 Million in POPCAT Liquidations

On November 12th, an unknown trader withdrew $3 million in USDC from OKX, split it across 19 wallets, opened $20-30 million in leveraged longs on POPCAT to pump it to $0.21, then triggered a 43% crash to $0.12 in 30 minutes causing $63 million in total liquidations

Hyperliquid’s insurance fund had to absorb $4.9 million in losses while the platform paused deposits and withdrawals for hours, and this is the THIRD similar incident on Hyperliquid in 2025 - even CZ had to specifically deny Binance’s involvement

This is the textbook definition of why people are nervous about decentralized perps with thin liquidity - when one person with $3 million can cause $63 million in carnage, you have to ask if the “decentralized” part is worth it when there’s not enough liquidity depth to prevent manipulation that would get you arrested on a centralized exchange

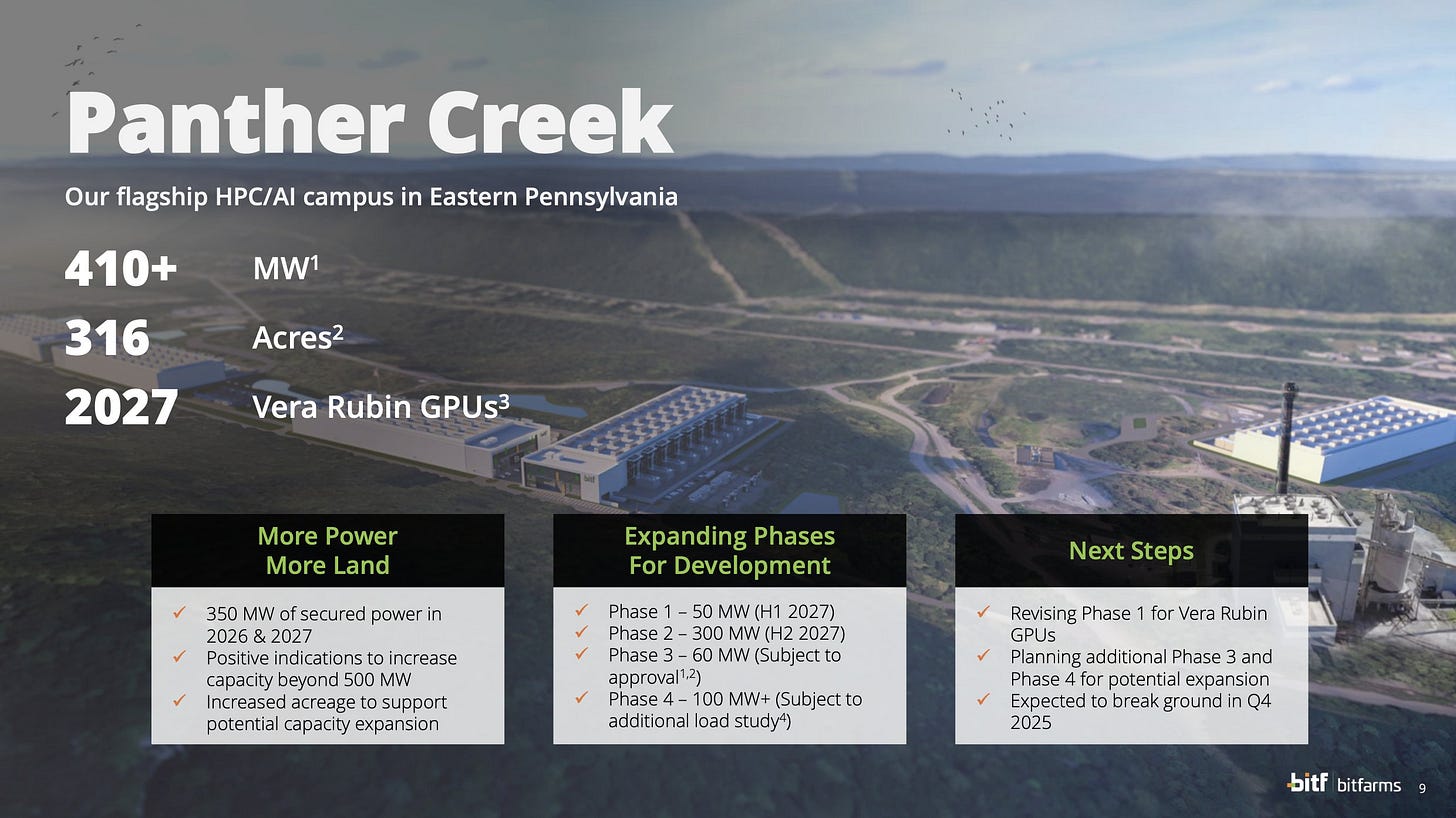

Bitfarms Exits Bitcoin Mining for AI Data Centers

Bitfarms, one of the established Bitcoin mining operations, announced they’re winding down their mining business entirely to focus on AI data centers, betting that AI compute will be more profitable than Bitcoin mining

This represents a significant pivot from a company that built its entire business model around securing the Bitcoin network, now chasing the AI infrastructure boom that’s driving massive demand for GPU compute power

The move reflects broader pressure on Bitcoin miners from rising energy costs, increasing network difficulty, and the reality that AI companies are willing to pay premium rates for the same infrastructure - when AI labs are desperate for compute and paying top dollar, mining Bitcoin at thin margins starts looking less attractive.

Now let’s jump to Luke Hajdukiewicz, Chief Growth Officer, at Blueprint Finance to talk about stablecoins in the UK.

Thank you Luke. Check out Blueprint’s website in the show notes.

LITTLE BITZ

The first-ever spot XRP ETF launched trading in the U.S., marking another milestone for crypto ETF approvals after years of SEC battles with Ripple.

Grayscale, the Bitcoin and Ethereum ETF operator, filed for an IPO that would make them the first major crypto asset manager to go public since Coinbase.

SharpLink Gaming posts $104M profit from ETH treasury, a 1000%+ increase. They are the first DAT to complete a full quarter dedicated to Ethereum.

WHERE TO FIND DCN

EMAIL or FOLLOW the Hosts

Quile

Email: kyle@dailycryptonews.net

X: @CryptoQuile

——————————————————————

***NOT FINANCIAL, LEGAL, OR TAX ADVICE! JUST OPINION! WE ARE NOT EXPERTS! WE DO NOT GUARANTEE A PARTICULAR OUTCOME. WE HAVE NO INSIDE KNOWLEDGE! YOU NEED TO DO YOUR OWN RESEARCH AND MAKE YOUR OWN DECISIONS! THIS IS JUST EDUCATION & ENTERTAINMENT.