Good morning, everyone.

I’m Matt, and this is your Daily Crypto News.

Plenty happened over the weekend — one story, in particular, has everyone talking.

We’ve got Epstein, Bitcoin, AI gone creepy, and a full breakdown from Craig Cobb. Let’s get into it.

EPSTEIN, BITCOIN, AND THE SATOSHI THEORY

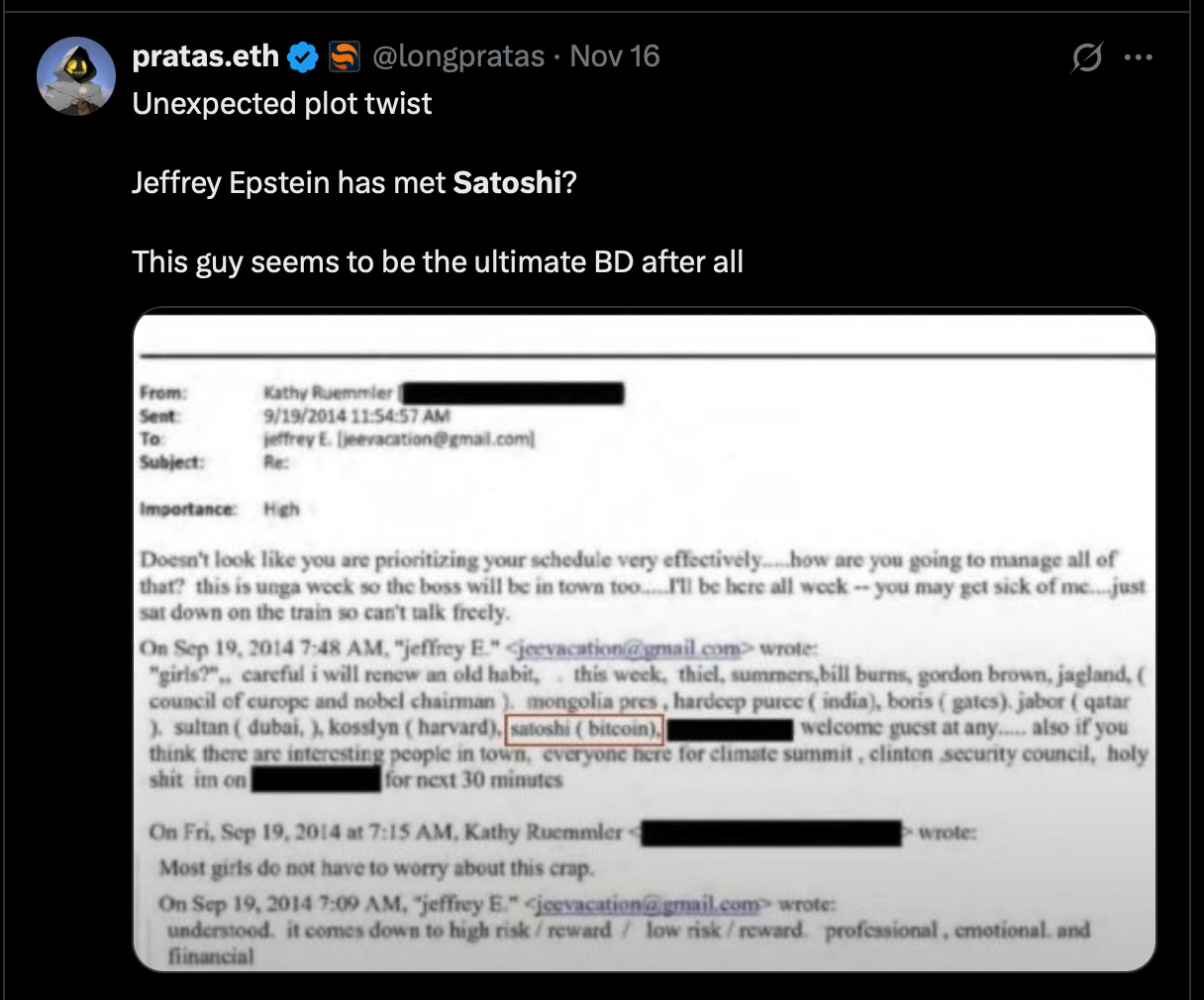

Newly released Epstein emails are now brushing up against crypto history.

One 2014 email reportedly mentions a meeting with “Satoshi (Bitcoin).”

Was Epstein about to meet Bitcoin’s creator? Did he actually know who Satoshi was?

Hal Finney — the early cryptographer and first person to ever receive Bitcoin from Satoshi — died in August 2014.

The Epstein email mentioning “Satoshi” was sent in September.

If Epstein didn’t know Hal had already passed, that could explain the reference.

If he did know… well, that’s where the conspiracy crowd is running wild.

Epstein’s later emails show him deeply preoccupied with Bitcoin taxation and policy.

He emailed Steve Bannon in 2018 asking whether the Treasury Department or the National Security Council was controlling crypto regulation.

He described “our crypto coin issues” as mostly tax and disclosure problems, compared Bitcoin to the early internet, and slammed Facebook’s Libra project as a potential “systemic risk” — all weeks before his arrest.

My Take

It’s wild that Epstein was thinking about Bitcoin at all — even more that he saw it through a policy lens.

But whether or not he actually “knew Satoshi,” the timing around Finney’s death makes the simplest explanation still the most likely: coincidence, not revelation.

SAILOR “SELLING” RUMOR GOES NUCLEAR

Traders on Polymarket turned a screenshot misunderstanding into a 10x win.

Someone spotted large Bitcoin transfers labeled in red on Arkham Intelligence, assumed it was Michael Saylor’s MicroStrategy dumping coins, and the rumor went viral.

Polymarket odds of “Saylor sells Bitcoin” jumped from 3% to 45%, and MicroStrategy shares slid in pre-market.

Saylor later went on CNBC and confirmed: no sales, just wallet movements.

Polymarket odds snapped back under 5%, leaving only the rumor traders with profits.

My Take

Classic case of panic in a thin market. One red font and everyone loses their mind.

This is what happens when liquidity is tight and trust is thinner.

AI COMPANY LETS YOU TALK TO THE DEAD

A startup called “2Y2WAI” went viral for letting users build talking avatars of their dead relatives using old videos or voice clips.

You can literally have an AI-powered conversation with your deceased family member — and one promo showed a woman getting parenting advice from her late mom’s avatar.

The internet called it “demonic” and “straight out of Black Mirror.”

The founders, including a former Disney actor, say everything is consent-based and processed locally on-device.

Still, lawyers note there are zero legal protections for deceased likeness or family data in the U.S.

My Take

Creepy? Maybe.

Illegal? Probably not.

If it helps people process grief — fine. But it’s a dangerous slope once avatars start advising you like they’re real.

HARVARD AND EMORY GO LONG BITCOIN

Both Harvard Management Company and Emory University quietly increased their Bitcoin ETF exposure last quarter.

Harvard tripled its stake in BlackRock’s iShares Bitcoin Trust (IBIT) to $443M.

Emory added positions in Grayscale’s Mini Trust and IBIT, totaling $52M.

Combined, that’s roughly half a billion dollars in Bitcoin exposure among Ivy League endowments.

My Take

Two years ago, this would’ve been unthinkable.

Bitcoin is now a legitimate “long-term allocation” in elite university portfolios.

Number may go down short-term, but long-term conviction is going Ivy.

THE “EVERYTHING BUBBLE” WARNING

Analysts like Paul Krodowski are warning that AI + data centers + real estate + credit = a full-blown everything bubble.

Billions in GPUs are sitting idle because utilities won’t connect new data centers to the grid — literally stranded silicon.

Some projects are funded with off-balance-sheet debt eerily similar to pre-2008 mortgage structures.

He calls it a perfect storm of “sexy tech, easy credit, and government backstop,” predicting an unwind over 4–5 years.

My Take

The irony? This could keep markets inflated longer before it pops.

We’ve built another dot-com era — but this time, with GPUs instead of routers.

Number go up… until the power bill comes due.

CRAIG COBB’S MARKET TAKE

Craig Cobb joined to break down the charts:

No confirmed trend reversal yet. We need a lower high on the monthly before calling this a bear.

Bitcoin still in an uptrend, even after a brutal 10% week.

$90K range looks like a clean pullback zone.

Altcoins holding stronger than expected — TRON, XRP, and LINK especially.

Liquidity is the missing ingredient. Once the government’s back online and paychecks resume, Craig expects a “push of oxygen” into risk markets.

Craig’s Words:

“These are the moments when everyone screams.

These are the times to accumulate.”

LISTENER COMMENTS

Jeroen: Thinks Bitcoin will bounce off $89K and go up again now that the shutdown’s ending.

Matt’s Response: I think we’re in Schrödinger’s bull/bear market. Both can be true. We’ve got bullish fundamentals and bearish liquidity. Pick your poison.

Jason: Sold at $119K with a $43K cost basis. “Best feeling ever.”

Matt’s Response: Taking profits isn’t luck — it’s discipline. People mock retail investors for losing money, then call them greedy when they win. You took risk, you earned it.

Nick: Holding Casper, down 80%.

Matt’s Response: Look at the catalyst for its last run-up. Was it a listing? A one-off liquidity event? That probably set the “real” price where it is now.

CRYPTO PRICES — 8:46 AM ET

Bitcoin (BTC): $93,791 (-1.5%)

Ethereum (ETH): $3,113 (-1.0%)

XRP: $2.21 (flat)

BNB: $912 (-1.6%)

Solana (SOL): $138 (-0.3%)

TRON (TRX): $0.291 (-1.1%)

Dogecoin (DOGE): $0.159 (-1.0%)

Cardano (ADA): $0.481 (-2.0%)

Total Market Cap: $3.20T (-0.9%)

Bitcoin Market Cap: $1.87T

Ethereum Market Cap: $376B

Fear & Greed: 17 — Extreme Fear

RSI: 41 — Oversold

SUMMARY

Epstein’s ghost just touched Bitcoin lore, AI is raising the dead for real, Ivy Leagues are aping into ETFs, and the “everything bubble” has a power problem.

Craig Cobb says stay calm — the monthly uptrend isn’t broken.

Me? I think we’re sitting right between bull and bear, waiting for the next catalyst.

Happy HODLing, Everyone.

References & Affiliates

🕵️ Jeffrey Epstein Emails Mention Bitcoin, Crypto Taxes, and Steve Bannon

💰 Traders Earned 10x on Fake News That ‘Strategy’ Sold Bitcoin

🤖 ‘Demonic’ AI App Lets Users Talk to Dead Loved Ones, Faces Backlash

🏦 Harvard Triples Bitcoin Position, Emory Expands BTC ETF Holdings

📈 The Everything Bubble Explained

Self-Custody Crypto Roth IRA: athenic.xyz

Use Code DCN for $30 off: DCN

Where to Find DCN:

🌐 DailyCryptoNews.net

🐦 twitter.com/DCNDailyCrypto

📈 Trader Cobb on X

🌿 The Grow Me Co

Disclaimer

This content is not financial, legal, or tax advice. It reflects personal opinions for educational and entertainment purposes only.

I am not a financial advisor or expert, and I do not guarantee any specific outcome.

Always do your own research before making any investment or financial decisions.

©Copyright 2025 Matthew Aaron Podcasts LLC