Hey, it’s Fly you Fools! Before you dive into today’s piece, I need your help with something.

I’m running a quick experiment about crypto terminology – you know how we keep inventing new “Fi” variants every few months? DeFi, GameFi, CeFi, SocialFi, and about seventeen others I can’t even remember?

I want to know: are we all just nodding along pretending we know what these terms mean, or do we actually get it?

I’ve set up an anonymous poll that takes about 2-3 minutes. Just gut reactions to simple statements about crypto terminology. No right or wrong answers, I literally just want to know what people actually think.

Important: Don’t research anything first! I need your honest, unfiltered takes.

We’ve got about 50 responses so far from builders, users and observers, but I need more data points to see the real picture. The more people who participate, the better the analysis will be.

Take it here: pol.is/4whbcsbwy8

I’ll share what we discover in next week’s newsletter! Now, onto today’s article…

Hey good degens — welcome to your Thursday download on Daily Crypto News. I’m Quile.

It’s been a week where TradFi can’t help itself. The NYSE is betting on bets, CZ’s back with a billion, and the S&P just gave crypto its own scoreboard. Banks are funding stablecoin rails, Circle’s minting stables like it’s 2021, and gold’s now past four-grand — the sound-money showdown is officially on.

Meanwhile, Ethereum’s having a moment — launching a privacy research cluster, breaking records on L2 volume, and shipping more product in a month than most chains do in a year. From Ondo’s tokenized stocks to Aave flipping a U.S. bank, the network demonstrates its ability to scale and shield in real time.

And if you zoom out, institutions are building, governments are stacking, and the market’s still in the euphoria phase.

We’ve got a listener question here from Dave K. Dave is asking if you can take a loan out on your Bitcoin.

The short answer is yes, you can. There are lots of ways to do this. There was actually an $82M fundraise announced this week from Meanwhile which is Bitcoin life insurance.

But, the loan options exist across crypto. The crazy part is DeFi looping. You can essentially turn $1 into $2 through staking and then taking loans out on that derivative. It can almost be infinite. Watch out for impermanent losses.

Be sure to check out the poll in our Substack. We’re doing a fun article to show how much people know and don’t know about crypto terms.

We’re constantly producing content. We’ve got some more interviews lined up this month. Should be an exciting month of content for you all.

OCTOBER 9 - HEADLINES

NYSE Owner Bets on Polymarket — $2 B Investment

Wall Street wants in on the gambling meta.

Intercontinental Exchange (ICE) — parent of the NYSE — will invest up to $2 billion in Polymarket, valuing the prediction-market platform at roughly $10 billion.

Translation: TradFi’s betting on bets

CZ’s YZi Labs Unveils $1 B Fund for BNB Chain

BNB is just pumping….

Changpeng Zhao’s family office announced a $1 billion developer fund for BNB Chain, reinforcing its comeback narrative even as markets cool.

CZ also says “BNB Chain gas fees have been reduced by 2000% this year.”

BNB Smart Chain Stats

Just hit a new record: 5T gas used in a single day.

77% of transactions came from swaps yesterday, totaling 24M trades.

$56M in trading revenue in one day

BNB Chain is where real trading happens onchain - Is it the people’s chain?

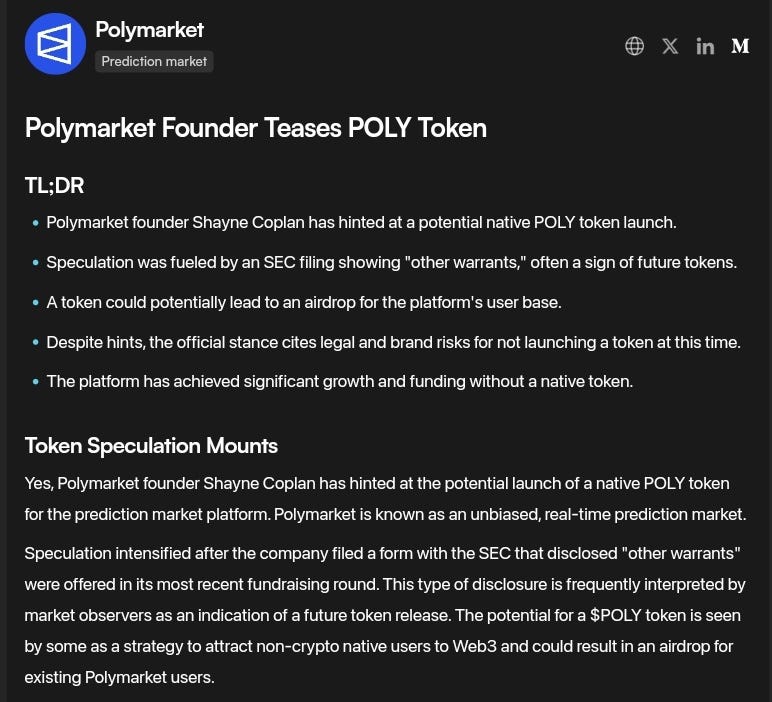

S&P Launches the “Digital Markets 50” Index

TradFi’s scoreboard just went on-chain.

The S&P Digital Markets 50 tracks the top 50 digital assets like a Nasdaq-for-crypto benchmark.

The new benchmark, called the S&P Digital Markets 50 Index, will track 50 major components across the crypto economy, including 35 publicly traded companies tied to blockchain and digital asset operations, and 15 cryptocurrencies selected from the existing S&P Cryptocurrency Broad Digital Market Index.

TradFi Goes On-Chain: Citi, Visa & BVNK

Citi joined Visa in funding BVNK, a stablecoin payments network for institutional settlement.

→ The Bank of France simultaneously called for direct EU oversight of crypto firms, while State Street found institutional investors expect to double digital-asset exposure within three years.

Takeaway: banks aren’t fighting crypto anymore — they’re building on it.

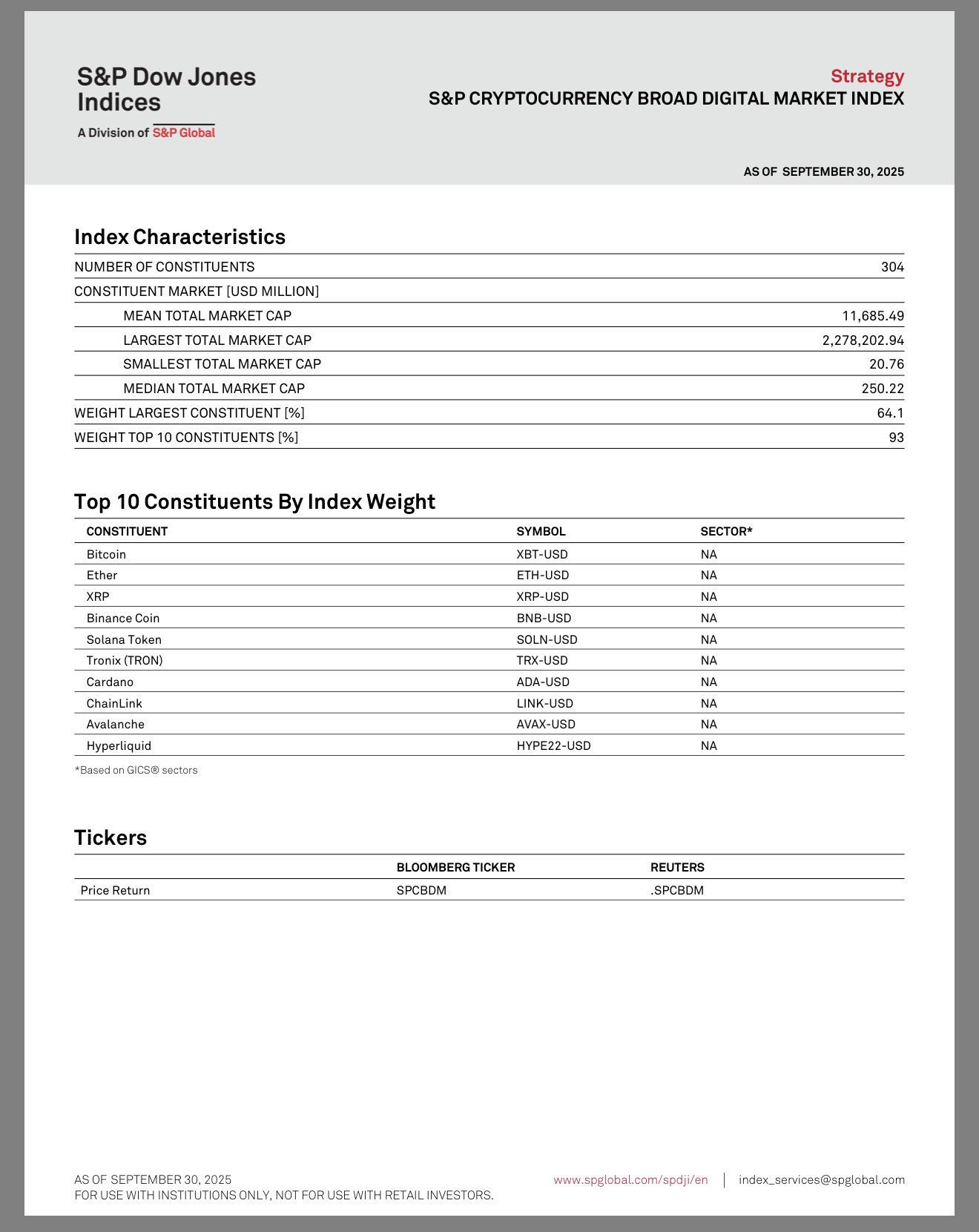

Ethereum’s Privacy Era Begins - Ethereum Ecosystem Flexes Muscle — 27 Major Launches

The Ethereum Foundation launched a dedicated privacy research cluster, advancing ZK cryptography and confidential transactions.

Builds on the Fusaka testnet upgrade and record-setting Q3 metrics:

$5 T stablecoin volume

25 M L2 transactions in one day

16 M verified Worldcoin users

Ethereum is scaling and shielding — privacy and performance are converging.

The past few weeks delivered a blitz of execution across Ethereum and L2s:

Ondo Finance launched Global Markets with 100+ tokenized U.S. stocks & ETFs

Aave now holds more assets than a top-40 U.S. bank

Coinbase × Morpho Labs rolled out on-chain lending for USDC

Celo activated Ice Cream Hardfork featuring EigenDA v2

Aragon × MetaLeX introduced BORGs — programmable legal entities

Kraken × xStocksFi bringing tokenized stocks to Ethereum

Cloudflare × Coinbase launched x402 Foundation for network-native transactions

Takeaway: Ethereum isn’t waiting for headlines — it’s shipping a new financial internet week after week.

LITTLE BITS

Monad Drop is expected next week.

Joseph Lubin: IP is shifting “from legal control to cultural consensus.”

North Korean hackers up to $2 B stolen in 2025, triple last year.

95% of BTC now in profit territory — Glassnode calls it the “euphoria phase.”

Finally…

Go listen to Geese. Like Wow, this band. Cameron Winters. The drumming. If you like LCD Soundsystem or The Strokes or Arctic Monkeys - Check em out. Hottest band in Brooklyn.

They have a great song about taxes… Almost better said than George Harrison’s Taxman. (Music video below)

“If you want me to pay my taxes

You better come over with a crucifix

You’re gonna have to nail me down…”

WHERE TO FIND DCN

EMAIL or FOLLOW the Hosts

Quile

Email: kyle@dailycryptonews.net

X: @CryptoQuile

——————————————————————

***NOT FINANCIAL, LEGAL, OR TAX ADVICE! JUST OPINION! WE ARE NOT EXPERTS! WE DO NOT GUARANTEE A PARTICULAR OUTCOME. WE HAVE NO INSIDE KNOWLEDGE! YOU NEED TO DO YOUR OWN RESEARCH AND MAKE YOUR OWN DECISIONS! THIS IS JUST EDUCATION & ENTERTAINMENT.