Alright alright alright, folks. Wednesday, September 10.

Do you all remember that show on MTV - Celebrity Deathmatch? The like claymation super bloody, gory battles? Well, let’s get it on.

Man that jobs report is really dragging down the macro- sentiment. Crypto doesn’t happen in a vacuum.

Oooh we it’s one of the best times for sports in world right now at least. Baseball heating up. Football everywhere getting underway: NFL, UEFA, NCAA - It’s here. I’m here for it.

Lol did you all see Tucker Carlson ragging on Mark Cuban at the All In Summit? I mentioned this yesterday. But lots of high level points out of the conference. Nasdaq and stock tokenization is coming. 24/7 trading is coming.

I actually heard this analogy recently: we’re becoming digital cavemen who can now trade anything for anything again. In the current paradigm, we have to trade stock to fiat. Bond to fiat and back to stock. Fiat is the intermediary. Not anymore. The paradigm is shifting. There’s a new ‘zeitgeist’ on the way. True composability is on its way. Trade ETH for USDC to BNB to SOL all in a few clicks, natively across various blockchains with interoperable connection all verified through globally decentralized validator services that are secured through decentralized staking layers built for autonomous AI verification — and the hyperloop of decentralization unravels into the ether.

GIMME THE HEADLINES:

Binance partners with $1.6 trillion asset manager Franklin Templeton "to build tailored digital asset initiatives.

The collaboration merges Franklin Templeton’s tokenization expertise with Binance’s global trading infrastructure to deliver institutional-grade blockchain products.

Aims to enhance settlement efficiency, collateral management, yield generation, and accessibility across capital markets.

Product launches expected later in 2025, targeting both retail and institutional investors.

Cracks in the Treasuries? Bloomberg rags on Saylor, highlighting decreases in mNAV

DAT stocks wobble, confidence fades: Shares of digital-asset treasury firms slid ~15% last week, with names like ALT5 Sigma and Kindly MD down 50–80%, raising doubts about the sustainability of the treasury-wrapper model.

Buying slows, premiums shrink: Treasury companies purchased just 14,800 BTC in August—an 80%+ drop from earlier this year—while “mNAV” premiums that once fueled valuations are eroding, even for leaders like Saylor’s Strategy.

Financing gets riskier: Firms are layering Bitcoin-backed loans, convertibles, and structured payouts to stay afloat—moves that add leverage and complexity just as investors question why not simply hold BTC or an ETF directly.

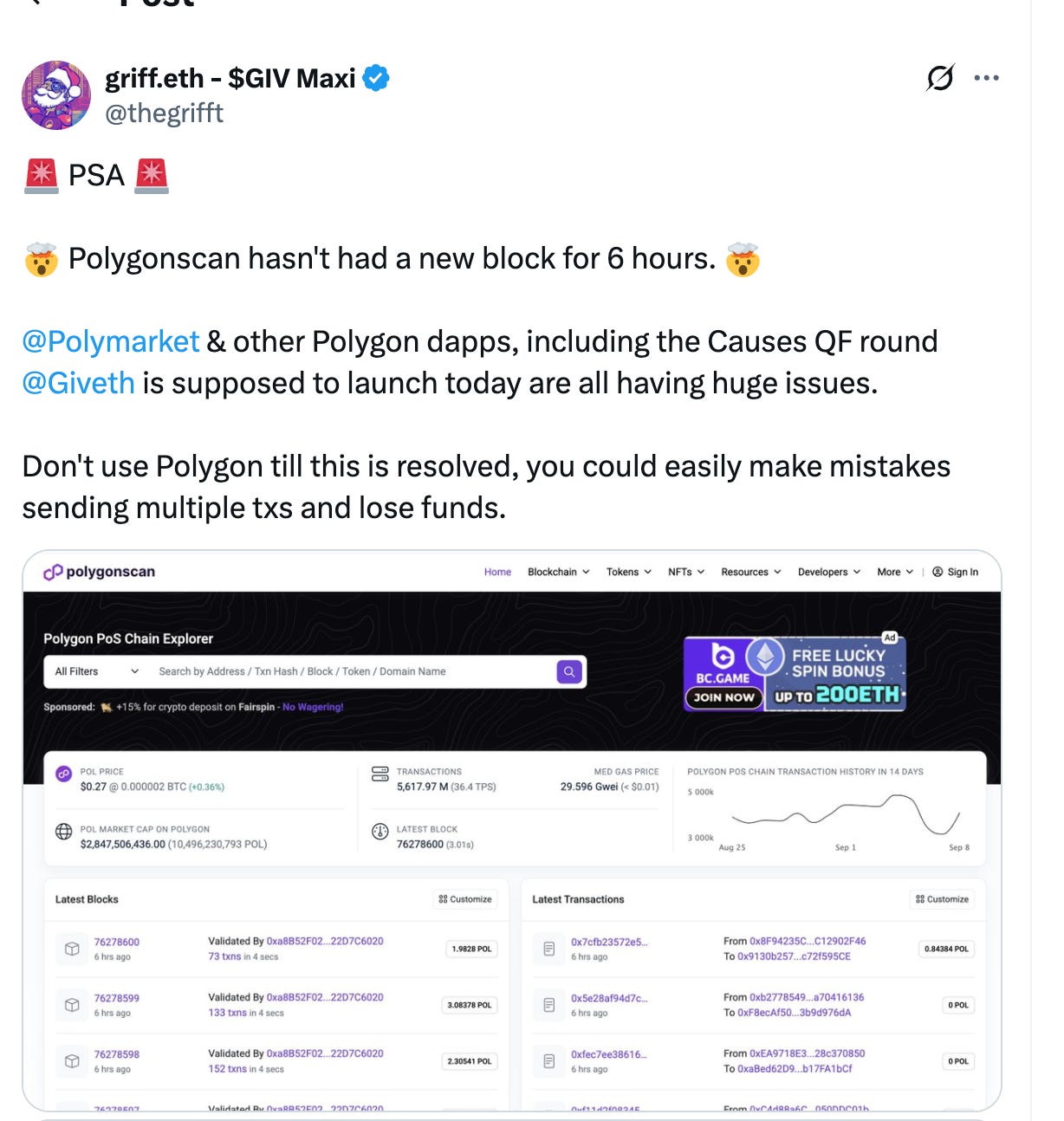

Polygon PoS chain faces delay in reaching consensus finality. What’s next for this chain?

The Polygon network is experiencing transaction finality delays of 10–15 minutes, impacting confirmations despite continuous block production. Latest news say that there hasn’t been a block in several hours.

Root cause: a bug in Bor/Erigon nodes and RPC providers, which the team is patching and rolling out to validators.

Heimdall v2 upgrade had promised fast finality, but trading was disrupted, with POL token dipping ~3%.

Polymarket is Polygon’s ticket to relevance

Polygon’s lifeline is Polymarket: The largest on-chain prediction market has exploded in cultural relevance, anchoring Polygon as the home of real-world event betting.

Unique edge vs. L2 rivals: While Arbitrum and Optimism chase DeFi and enterprise deals, Polygon can claim the go-to chain for election, sports, and macro markets

Narrative moat: Even as Polygon works on zkEVM and POL migration, Polymarket gives it the sticky use case that keeps it relevant in media and trading circles.

Metaplanet Sets $1.45B Share Sale to Fund Bitcoin Purchases, Treasury Shift

Metaplanet launched a $1.45 billion share sale to fund aggressive Bitcoin accumulation and shift toward a crypto treasury model. (no citation available in recent search results)Related context: Metaplanet stock has dropped over 60% from its June highs, even as its Bitcoin holdings remain a key strategic play

Globally, crypto treasury companies are under pressure amid a broader market pullback in speculative digital asset equities.

India resists comprehensive crypto regulation amid systemic stability fears.

A strategic blocker or neutral stance from a top-10 economy can shape global regulatory trajectories.

No comprehensive crypto law yet: India is opting to avoid a full legal framework for cryptocurrencies, favoring a partial oversight model. This cautious stance stems from a government document seen by Reuters revealing that the Reserve Bank of India (RBI) considers formal regulation as potentially “legitimizing” crypto and increasing its systemic risk in the financial system.

A recent survey from Mudrex shows that 93% of Indian crypto investors want regulation, while 84% find current taxes unfair, indicating strong demand for clarity and reform even as the government remains cautious.

Little Bits

CoinGecko has integrated Bubble Maps V2 - If you don’t know BubbleMaps, go check it out. It’s a super cool tool to help visualize the contracts.

Minnesota Credit Union to Launch Stablecoin; St. Cloud Federal Financial Union Claims to Be First in U.S.

Kraken Expands Tokenized US Stocks to EU Clients

Have you ever heard that quote that’s like: we’re living in the era that’s too late for ocean exploration but too early for space travel? Voyager 1 just marked 48 years pushing through the ETHER.

Voyager 1 has the distinction of being the farthest human-made object from Earth – a record it has maintained since 1998 when it bypassed NASA's Jupiter-exploring Pioneer 10 probe.

Both Voyage Probes have spent nearly five decades traveling billions of miles away from Earth.

For as much as we spend stuck in these digital machines, there is soo much still out there. And with that, I’ll sign off for the day.

Go listen to the new Big Thief album. Double Infinity.

“Amputated dimension of the physical

Melting image without sound

Park Avenue, 838, waving to my best friend”

If you have to ring a bell, make sure its an Alexander Graham Bell, and if you have to buy bonds, make sure they are Barry Bonds.

Go Giants.

WHERE TO FIND DCN

EMAIL or FOLLOW the Host

Email: kyle@dailycryptonews.net

*****

Magic Newton Wallet

https://magic.link

Trader Cobb X: @TraderCobb

https://www.thegrowmeco.com/

Editing Services

https://www.contentbuck.com

——————————————————————

***NOT FINANCIAL, LEGAL, OR TAX ADVICE! JUST OPINION! I AM NOT AN EXPERT! I DO NOT GUARANTEE A PARTICULAR OUTCOME I HAVE NO INSIDE KNOWLEDGE! YOU NEED TO DO YOUR OWN RESEARCH AND MAKE YOUR OWN DECISIONS! THIS IS JUST EDUCATION & ENTERTAINMENT!