Whaddup, it’s Quile back with Daily Crypto News for Friday, November 7.

Look, memecoins are officially dead - and honestly? That might be the best thing that’s happened to crypto in a long time.

OGs who’ve been trading since late 2016 are saying they can’t recall a darker era than the Solana memecoin mania we just lived through. It stripped this space of its soul and let first-cycle scammers extract millions while we turned complete regards into celebrities.

That October 10 liquidation cascade sealed the deal. For two years, traders got wrecked by bot terminals, launchpads, and braindead KOLs - and didn’t even get the PumpFun airdrop.

Meanwhile, Solana co-founders are 24/7 shilling some privacy coin they got for free, in the same week SOL got a staking ETF approval. While SOL is down 33% this month. KOLs on Monad got preferred drops, too. Retail is exhausted.

But here’s the thing - we’re going back to DeFi narratives. Your memecoins aren’t coming back. But the opportunities are still there.

If this was your first cycle, I feel for you. But it can only get better from here. If you survived this, you’ll survive any cycle.

Crypto is still one of the best hedges against inflation.

Let’s talk about what’s actually happening in crypto while the memecoin tourists pack their bags.

Here are the headlines for today, November 7, 2025

CryptoQuant Bull Score Hits Zero for First Time Since January 2022

Kazakhstan Building $500 Million-$1 Billion National Crypto Reserve Fund From Confiscated Mining Rigs

Coinbase CEO Wants Your Stocks Trading Like Degen Coins at 3 AM

Tether Buys $97M Bitcoin During the Dip Because of Course They Did

Monad Announces Farming Program Ahead of November 24 Mainnet Launch

Some listener questions and comments:

Nunya is looking to hedge a small bet on the 12th and then wait til the FMOC Meeting -rate cuts are expected, but not entirely. We’ll see.

Holler out to Jan - makebeliever- for the shoutout on Geese. They really are the best band in the fuggin world right now.

Paul Shiny Coultrup says he knows someone saying BTC could see itself to the 30k range. Ya know, anything is possible. Really, macro cliffs are all in play. There is no government deal in sight. Flights are getting canceled. Doomsday is there.

1. CryptoQuant Bull Score Hits Zero for First Time Since January 2022

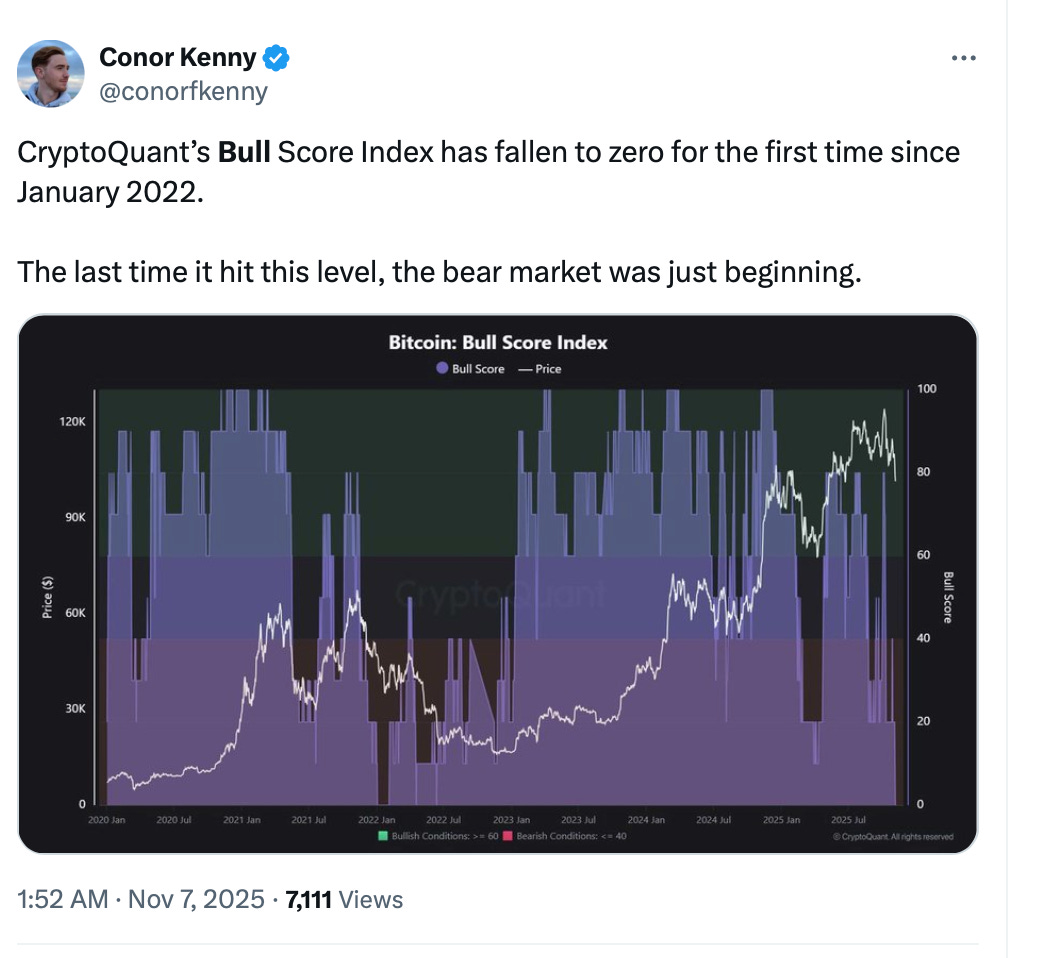

The CryptoQuant Bull Score Index dropped to zero on November 7, marking the first time the indicator has hit this level since January 2022 when BTC was getting bodied around $40K during the post-2021 correction

Bitcoin has dumped over 15% from its October peak to around $101,500, dropping below the 365-day moving average while the total crypto market has bled more than $1 trillion since early October

The index tracks bearish conditions using ETF flows, MVRV ratios, and on-chain metrics - some analysts are calling for a potential leg down to $72,000 if the $100K support gets violated

But here’s the cope: some analysts note the index historically lags price action, and exchange reserves remain at historic lows meaning long-term holders still aren’t selling - they’re just suffering in silence

2. Kazakhstan Building $500M-$1B National Crypto Reserve Fund From Confiscated Mining Rigs

Kazakhstan’s central bank announced plans to launch a national cryptocurrency reserve fund valued between $500 million and $1 billion by early 2026, partially funded by seized assets from illegal mining operations

Central bank Governor Timur Suleimenov told Bloomberg the fund will invest in crypto ETFs and digital asset company shares rather than holding actual crypto - because apparently direct exposure is too spicy for central bankers

The move is a massive shift for the resource-dependent economy toward digital diversification, with Kazakhstan already being one of the world’s largest Bitcoin mining hubs after China’s ban

This follows similar nation-state reserve plays, though Kazakhstan’s approach of turning confiscated mining rigs into a sovereign wealth fund is peak 2025 energy

3. Coinbase CEO Wants Your Stocks Trading Like Degen Coins at 3 AM

Coinbase CEO Brian Armstrong complained on X that “billions of people still have to wait for the US to wake up before they can trade the best financial markets” in what might be the most relatable take from a crypto CEO this year

Armstrong argued that trading hours and markets that close are “outdated” and that tokenized assets will be “better for everyone” with instant settlement and 24/7 availability - aka stocks should trade like SOL on a Tuesday

The post comes as institutional interest in tokenized securities and real-world assets continues heating up, with major TradFi players like JPMorgan and BlackRock actively building tokenization infrastructure

Armstrong’s vision: a world where global markets never sleep and you can panic sell at 4 AM like a true degen

4. Tether Buys $97M Bitcoin During the Dip Because of Course They Did

Stablecoin printer Tether purchased $97 million worth of Bitcoin during this week’s correction, continuing their gigabrain strategy of accumulating BTC with excess profits while everyone else is panicking

The purchase came as Bitcoin dipped below $101,500, with Tether consistently being one of the largest institutional Bitcoin accumulators over the past year - they’re basically the ultimate DCA bot

Tether’s Bitcoin treasury now holds substantial BTC reserves as part of its backing strategy, though the company maintains most reserves in traditional assets to keep regulators happy

When the entity that literally prints USDT is buying your dip, that’s either the ultimate bullish signal or the most suspicious thing you’ve ever seen - no in-between

5. Monad Announces Farming Program Ahead of November 24 Mainnet Launch

Monad, the EVM-compatible Layer 1 backed by Paradigm, just dropped details on a farming program tied to its MON token airdrop ahead of its November 24 mainnet launch - and CT is going absolutely feral about it

The blockchain promises 10,000 transactions per second with Ethereum-level decentralization through parallel execution and MonadDb, positioning itself as the performance upgrade the EVM ecosystem has been waiting for

Led by co-founder Armani Ferrante, Monad is designed to let Ethereum apps migrate seamlessly while actually solving scalability issues - not just kicking them down the road to Layer 2s

Investor Hasu’s take: “It’s Solana but for EVM” - Solana rebuilt the stack from scratch for performance, but EVM’s network effect is magnitudes bigger than SVM, creating a massive opportunity that Ethereum and its L2s haven’t fully captured yet

LITTLE BITZ

Bitcoin ETFs finally snapped their six-day outflow streak as some brave souls started buying the dip Wednesday

Tempo, the Stripe-backed blockchain payments startup, dropped $25 million on crypto infrastructure firm Commonware for a strategic partnership focused on making payments actually work on-chain

Paradigm identified as top $HYPE holder with 19,141,655 tokens ($763.18 million) spread across 19 addresses

WHERE TO FIND DCN

EMAIL or FOLLOW the Hosts

Quile

Email: kyle@dailycryptonews.net

X: @CryptoQuile

——————————————————————

***NOT FINANCIAL, LEGAL, OR TAX ADVICE! JUST OPINION! WE ARE NOT EXPERTS! WE DO NOT GUARANTEE A PARTICULAR OUTCOME. WE HAVE NO INSIDE KNOWLEDGE! YOU NEED TO DO YOUR OWN RESEARCH AND MAKE YOUR OWN DECISIONS! THIS IS JUST EDUCATION & ENTERTAINMENT.