Welcome to November 5th, where the crypto market just posted one of its sharpest corrections of the year and “extreme fear” isn’t just a sentiment indicator — it’s the vibe. Bitcoin briefly slipped below $100k for the first time since May, Ethereum touched $3,000 before clawing back to $3,200, and the total market cap shed roughly $250 billion as over $2 billion in leveraged positions got liquidated across the board.

Off the bat, here are some headlines:

Is the 4-Year Cycle Dead?

Binance Is Doing All the Selling — And That’s Weird

Solana ETFs Rip $70M While SOL Bleeds 20% — Peak Degen Divergence

Aave Buyback Program Passes With 100% Yes Votes — Governance Actually Works

Spotlight on HyperLiquid - Will it repeat the Solana cycle?

Let’s get to some listener comments.

Shoutout to Jayson. Feels like that scene from Jerry Maguire. Driving aimlessly at the wheel, screaming “FREE FALLING.” Stay strong, my man.

Skyler notes that he is seeing investors rotate into prediction markets rather than AltCoins. Gemini just launched prediction markets. Betting is everywhere. I’m not sure how much to read into this tho.

Fear and Greed Index is at 20. Almost a yearly low. Be careful out there, folks.

October broke the “Uptober” streak for the first time since 2018, November opened with a punch to the face, and everyone’s asking if this is capitulation or just a healthy reset before year-end. The fear is real, but so is the opportunity — especially if you’re hunting where capital’s actually flowing rather than where it’s fleeing. November is historically the top month for blockchain.

This year just feels different. Shutdown and Trump. It just doesn’t feel ripe.

Let’s get beyond the headlines as this is a good transition.

Is the 4-Year Cycle Dead?

Bitcoin’s only up ~53% over the past four years — or a measly ~36% when adjusted for inflation — while the S&P 500 gained 47% and gold absolutely crushed with 111% returns

Previous 4-year cycles saw Bitcoin pull 10x-20x gains, and now we’re celebrating barely outpacing the stock market while getting destroyed by boomer rocks

This raises existential questions about the halving-driven supercycle thesis: are we seeing diminishing returns as Bitcoin matures into a boring macro asset, or is this just an awkward mid-cycle lull before the real parabolic move?

The timing’s brutal — Bitcoin hit a new ATH at $122k this cycle but still can’t deliver the explosive returns that made it famous, leaving CT split between “it’s over” doomers and “$500k by 2026” hopium addicts

Binance Is Doing All the Selling — And That’s Weird

This wasn’t a broad institutional de-risk event — it was a Binance event that dragged the entire market down, which means the selloff could reverse just as fast if those specific sellers exhaust

CVD (Cumulative Volume Delta) data shows nearly all active Bitcoin spot selling pressure over the past two days came from Binance — while Coinbase, Bybit, OKX, and Kraken stayed basically flat

Binance spot CVD dropped from 0 to nearly -5,000 in 48 hours, while other exchanges barely budged — suggesting this isn’t broad-based panic but concentrated selling from one venue

The same pattern shows up in perps: Binance perpetual CVD cratered to -$3.6B while other exchanges show mixed or neutral positioning, indicating either whale capitulation, forced liquidations, or panic specific to Binance users

Why it matters: When only one exchange drives the entire market dump, it’s either (a) a few mega-whales exiting through Binance, (b) retail panic concentrated on the world’s largest exchange, or (c) something specific happening with Binance users that isn’t affecting Coinbase/offshore traders

Solana ETFs Rip $70M While SOL Bleeds 20% — Peak Degen Divergence

This is what capital rotation looks like in real-time — smart money farming staking yields through ETFs while CT gets rekt longing spot

Solana spot ETFs posted a record $70 million in single-day inflows on November 3rd while SOL token absolutely cratered from $205 to $155 — down 20% in a week

Bitwise’s BSOL ETF alone sucked in $66.5 million, with five straight days of positive flows totaling over $269 million since launch — while the underlying asset got destroyed

The disconnect is wild: institutions buying the wrapper while degens panic-sell the token, breaking SOL’s 211-day uptrend and testing support at $155 with next stop potentially $120

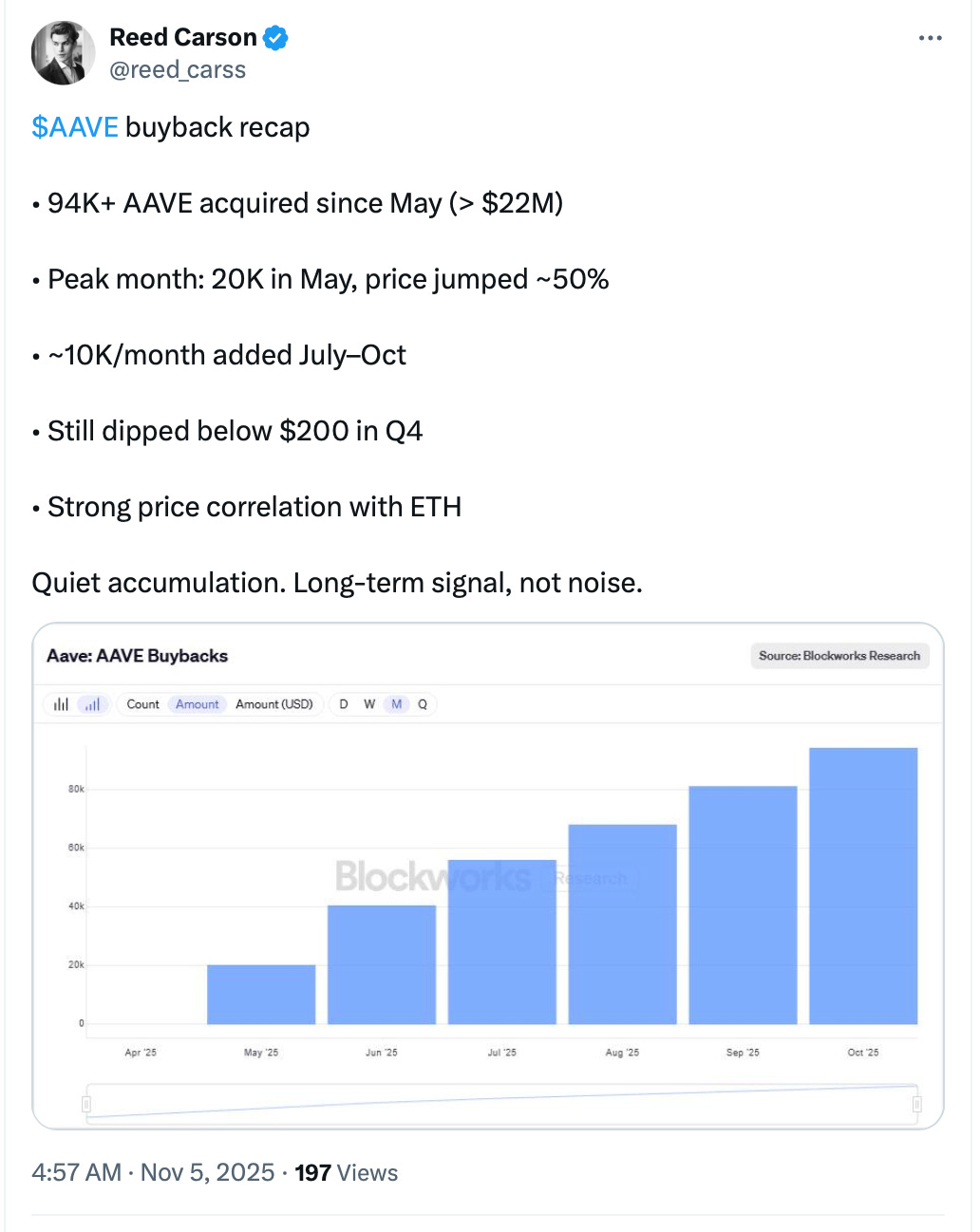

Aave Buyback Program Passes With 100% Yes Votes — Governance Actually Works

Aave’s new token buyback program just cleared governance with unanimous approval, marking a rare moment of community alignment in a sea of red

The proposal means Aave will use protocol revenue to buy back tokens from the market, adding buy pressure and returning value to holders in a bear-friendly way

While the broader market dumps $250B and institutions flee ETFs, Aave’s showing that strong fundamentals and actual revenue can still drive real governance decisions

This isn’t just a buyback it’s a clear signal of confidence in Aave’s own revenue model.

New HybraFinance Launches on Hyperliquid — But Memories of SOL Remain Fresh

Fresh project HybraFinance just launched on Hyperliquid, positioning itself as a “public liquidity layer” with an upgraded G(3,3) flywheel and dynamic fees

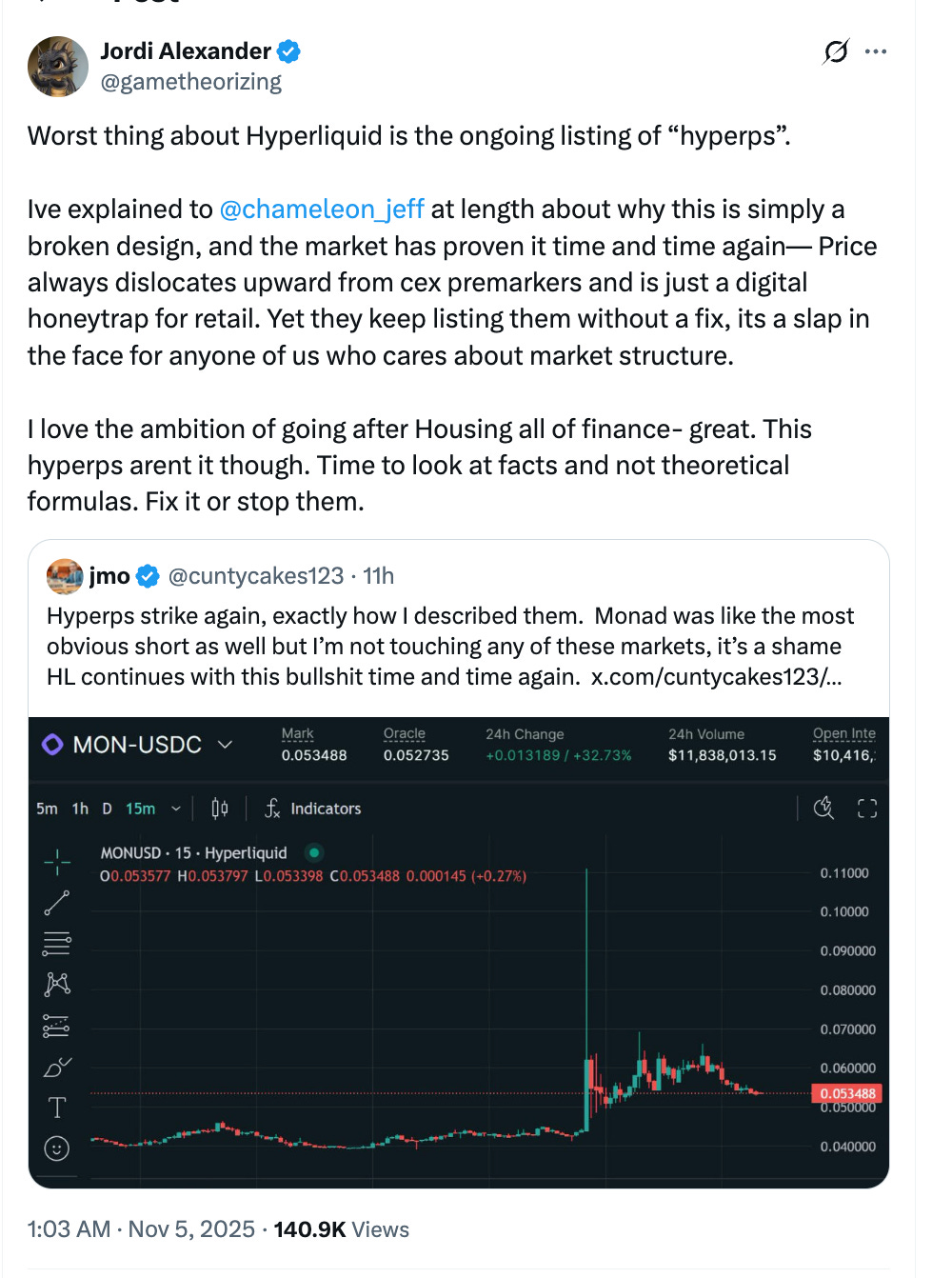

A viral X post by trader TradeButWhy on November 4, 2025, compared Hyperliquid’s HYPE token to Solana’s 2022 crash from $260 to $8, warning holders of complacency amid the perp DEX trend. Defenders countered by emphasizing HYPE’s $800 million annualized revenue, 92% buyback allocation, and 9x P/E ratio, contrasting it with Solana’s speculation-driven decline tied to FTX collapse and network issues. As HYPE trades at $36 after a 36% drop from its $59 peak, the debate highlights divisions in crypto sentiment over its long-term resilience.

Coming at a time when Hyperliquid continues to dominate perps volume (sitting in top 10 DEXs), new liquidity infrastructure plays are attracting degen attention despite market conditions

Over the past 24 hours, Hyperliquid DEX has surged to generate more than $4.3 million in revenue—emerging as the most profitable protocol in the crypto space (excluding stablecoin issuers like Tether and Circle), even as broader market conditions remain deeply bearish.

NOW LETS GET TO TRADER COBB AND THE MARKETS

LITTLE BITZ

SmartCon is happening in NYC. Chainlink SmartCon 2025 Unveils Runtime Environment and UBS Tokenized Fund Milestone

Bitwise CIO Matt Hougan says institutions are still buying - ETF inflows stay positive, and even the Solana ETF raised $400m during the dip. He believes sellers are almost exhausted.

Ripple Swell 2025: We have closed a $500 million strategic investment at a $40 billion valuation, led by Fortress Investment Group and Citadel Securities:

→ $95B+ in total Ripple Payments payment volume

→ $1B+ $RLUSD stablecoin market cap

→ 6 strategic acquisitions completed in just over 2 years

→ 25% of shares repurchased

→ 3x growth in Ripple Prime business

→ 75 regulatory licenses globally

This is the momentum building the Internet of Value.

WHERE TO FIND DCN

EMAIL or FOLLOW the Hosts

Quile

Email: kyle@dailycryptonews.net

X: @CryptoQuile

——————————————————————

***NOT FINANCIAL, LEGAL, OR TAX ADVICE! JUST OPINION! WE ARE NOT EXPERTS! WE DO NOT GUARANTEE A PARTICULAR OUTCOME. WE HAVE NO INSIDE KNOWLEDGE! YOU NEED TO DO YOUR OWN RESEARCH AND MAKE YOUR OWN DECISIONS! THIS IS JUST EDUCATION & ENTERTAINMENT.