Good morning, everyone — it’s your Daily Crypto News. My name’s Matt, and it is nine o’clock on Tuesday, October 14, 2025.

First off, yes — I know. Yesterday’s Trader Cobb episode was a week old. That was a file mix-up, and I’ll take the blame for not double-checking the upload. We’ll have the proper updated episode posted to Substack later today at DailyCryptoNews.net.

Also, quick note — Kyle (aka Crypto Quile, aka Comrade Kyle) will host Thursday and Friday’s shows while I’m out of town for a wedding this weekend.

Alright, let’s get into it.

Ethereum Developers Trial Fusaka Upgrade

Ethereum developers have launched the Fusaka upgrade on the Sepolia testnet, marking the next big step toward more efficient validator operations and transaction processing.

We’ve got a full write-up on this one on Substack — I recommend checking it out. Staff writer Maxwell Mutuma did a great job breaking it down for Decrypt, and it’s one of those technical updates that doesn’t make big headlines but has massive long-term implications for scalability.

My Take:

Ethereum’s back to shipping meaningful upgrades again, and this one looks like it’s setting up for better execution layers. These are the kinds of developments that don’t pump the chart immediately, but they make ETH stronger over time — and honestly, that’s how you build longevity in this space.

Understanding Leverage — and Friday’s $19B Liquidation Event

Leverage 101 (and why $19B got nuked)

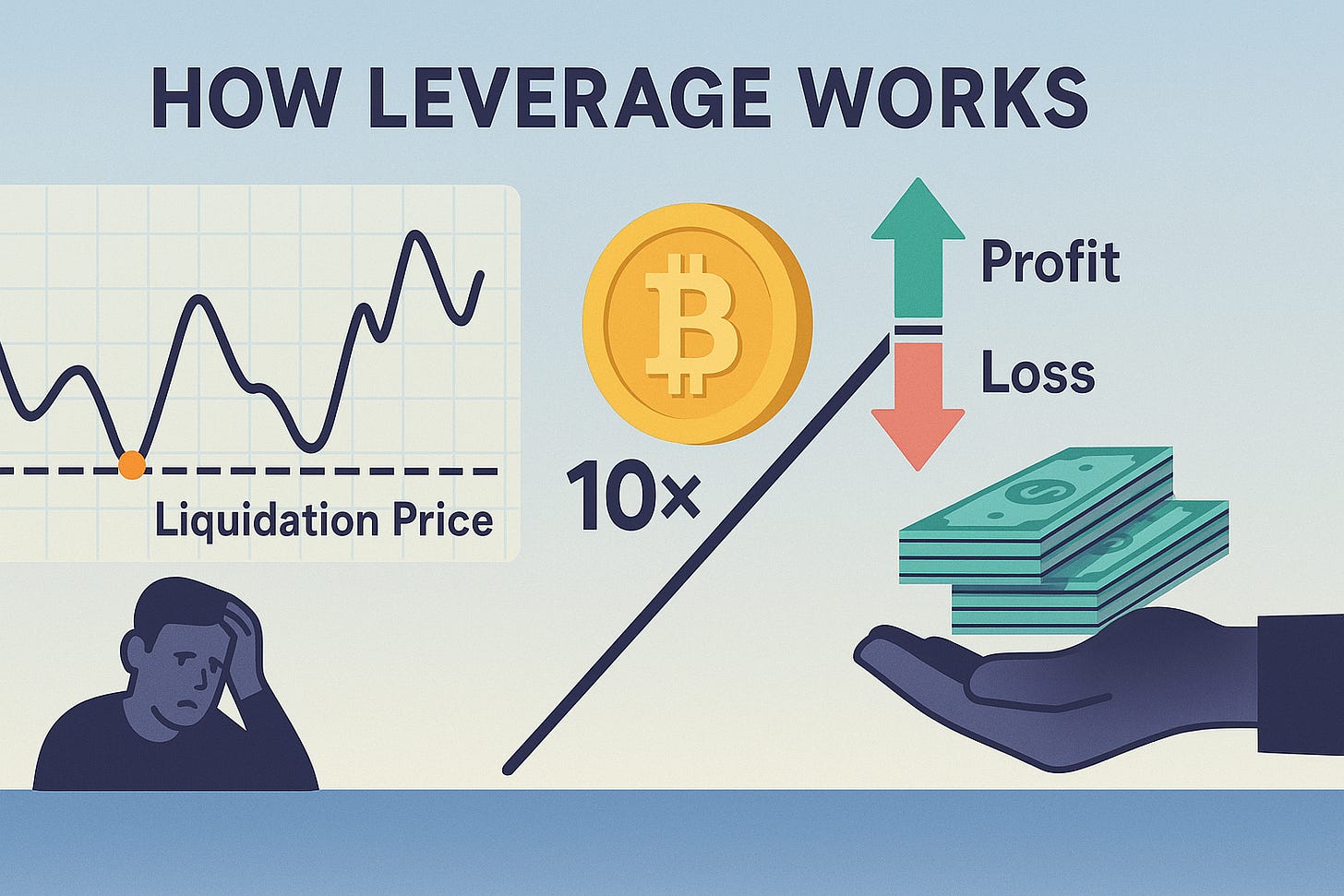

Leverage = borrowed exposure.

1× (spot): +/−5% move = +/−5% P&L.

10×: +5% move = +50%; −10% move = liquidation.

20×: +5% = +100%; −5% = liquidation.

100×: ±1% and you’re done.

When price shocks hit, exchanges liquidate at thresholds, which sells into a falling market (or buys into a ripping one), creating cascades.

Friday’s wipeout, by the numbers:

Friday’s $19 billion crypto market wipeout is being framed less as a chaotic collapse and more as a “controlled deleveraging,” according to blockchain analysts—though not everyone agrees.

The flash crash cut open interest on decentralized exchanges from $26 billion to under $14 billion, while lending fees hit record highs above $20 million and total borrowing dropped below $60 billion for the first time since August.

CryptoQuant’s Axel Adler Jr. said roughly 93% of the $14 billion decline in open interest reflected an organic unwinding of leverage rather than forced liquidations. Only about $1 billion in long Bitcoin positions were liquidated, which he called “a very mature moment for Bitcoin,” signaling improved market structure despite volatility.

But others blamed market makers for worsening the crash.

Blockchain sleuth YQ and analytics firm Coinwatch reported that liquidity collapsed by 98% on Binance and other exchanges after President Trump’s tariff announcement.I don’t trade leverage. I get why it’s tempting. Just…know the math before it knows you.

My Take:

Leverage amplifies both sides — big wins and brutal losses. It’s adrenaline trading. You start small, win once, and think you’re invincible — until the market moves half a percent against you and the whole position vanishes. This $19B flushout showed how fragile leveraged markets still are when sentiment and liquidity collide.

Steak ’n Shake Scraps Ethereum Payments

Steak ’n Shake has officially canceled plans to accept Ethereum payments — despite 53% of nearly 50,000 voters on X polls supporting it. The company cited backlash from Bitcoin maximalists and stated their “allegiance is with Bitcoiners.”

The decision came just months after the chain rolled out Bitcoin payments nationwide, crediting the Bitcoin community for a 10% same-store sales boost in Q2 and even stronger Q3 growth.

The company now plans to introduce a “Bitcoin Steakburger” on October 16th and will accept franchise fees in Bitcoin, according to its COO.

Even Vitalik Buterin weighed in, saying “not every business should chase broad appeal over conviction.”

My Take:

It’s hilarious but also symbolic. Bitcoiners are the loudest and most loyal crowd in crypto. When companies pick sides, they pick volume — not convenience. I still think dropping ETH was a mistake long-term, but it’s hard to argue with 10% higher sales. Steak ’n Shake just became the first fast-food chain to fully brand itself as Bitcoin-first.

Microsoft Faces Class Action Over OpenAI Partnership

Microsoft has been hit with a class action lawsuit accusing it of using its Azure cloud dominance to limit compute access to OpenAI, driving up ChatGPT subscription costs for years.

The suit claims Microsoft’s exclusive deal, dating back to 2019, allowed them to restrict AI compute supply, keeping ChatGPT prices 100–200x higher than competitors during the February 2025 AI price war.

Plaintiffs argue Microsoft effectively profited twice — once selling Azure compute to OpenAI, and again by taking 20% of ChatGPT’s paid revenue through its 49% stake in OpenAI’s for-profit division.

My Take:

This might end up being the defining tech antitrust case of the decade. Microsoft repackaged its ‘90s monopoly tactics in a new AI wrapper. The irony? The company that sells the AI that writes these lawsuits is now getting sued because of it.

California Passes Landmark Crypto Custody Law

California Governor Gavin Newsom just signed Senate Bill 822, making California the first state to ban forced liquidation of unclaimed cryptocurrency.

Previously, if an exchange reported unclaimed crypto under state unclaimed property laws, they had to sell it into cash before transferring it to the state — a move that triggered taxable events and headaches for owners.

Now, the new law requires companies to transfer the same asset type and private keys to state custody, where it can be held for up to 20 months before liquidation.

The bill also mandates owner notification 6–12 months before assets are reported as unclaimed, and ensures licensed custodians handle all transfers.

My Take:

I never thought about the tax hit from a forced state liquidation, but it’s a real one. California just set the gold standard for how to treat digital property like digital property. Expect other states to follow.

Citigroup Targets 2026 for Institutional Crypto Custody

Citigroup, the third-largest bank in the U.S., is officially entering the crypto custody game.

The bank plans to launch institutional-grade custody by 2026, with services for asset managers and institutional clients including safekeeping, segregation, and tokenized asset management.

This rollout fits into Citi’s broader roadmap: custody first, payments second, and token issuance last. They’re also exploring stablecoins for internal rails — but not for public issuance (yet).

My Take:

Every major bank is moving in this direction. Citi’s strategy is pure legacy finance efficiency: build the rails, not the meme. The next wave of “crypto adoption” is going to look a lot more like spreadsheets with blockchain backends.

Listener Comments

Caleb (with a C): asked if someone might’ve heard about China tightening rare earth exports and predicted Trump’s tariff response. Maybe. But what’s undeniable is that someone opened a multi-million-dollar short 30 minutes before the tweet. That’s not luck — that’s knowledge.

Will: called it “the craziest manipulation” he’s ever seen. Couldn’t agree more. These kinds of events show how small the space still is — one headline can erase billions in a blink.

Danny: said he snagged Render at $1.40 during the crash and already doubled up. Nicely done, man. That was the buy of the day.

Jason: I didn’t forget you. Appreciate the feedback, and yes, we’ll get our files and bots straightened out — even if I don’t care about your trading bots.

Crypto Prices

As of 9:24 a.m. Eastern

Fear & Greed: 42 (Neutral)

RSI: 40.8 (nearing oversold)

Bitcoin: $110,555 (−3.3%)

Ethereum: $3,939 (−4.0%)

BNB: $1,154 (−10.9%)

XRP: $2.40 (−5.9%)

Solana: $192 (+0.4%)

Dogecoin: $0.195 (−5.0%)

Tron: $0.310 (−3.3%)

Cardano: $0.668 (−5.4%)

Hyperliquid: $37.76 (−6.2%)

Render: $2.71 (−3.0%)

Total Crypto Market Cap: $3.74 trillion (−3.5%)

Bitcoin Dominance: $2.2 trillion

Ethereum Market Cap: $477.3 billion

Summary

Markets are digesting last week’s chaos and traders are still licking their wounds. Between Trump’s tariff tweets, Steak ’n Shake’s Bitcoin loyalty, and California’s new law, we’re watching a maturing space crash into real-world politics — again.

Prices are shaky, sentiment’s neutral, and liquidity’s thin — but fundamentals remain solid. Oversold is opportunity, not panic.

I’ll get my shit together — I promise.

Until tomorrow…

Happy HODLing, Everyone.

References & Affiliates

📉 Explaining Bitcoin’s Crash: Liquidations and Leverage at Play

💣 $19B Crypto Market Crash Triggered by Controlled Deleveraging Cascade, Analyst Says

🍔 Steak ’n Shake Dumps Ethereum Payments Plan After Pushback From Bitcoin Maxis

💸 Ethereum ETFs Bleed $429M in Largest Single-Day Outflow Since September

⚙️ Class Action Claims Microsoft “Choked” AI Supply, Driving Up ChatGPT Costs

🏛️ California Governor Signs Law for Forced Liquidation of Unclaimed Crypto

🏦 Citi Targets 2026 for Launch of Crypto Custody Services

Self-Custody Crypto Roth IRA:

athenic.xyz

Use Code DCN for $30 off: DCN

Where to Find DCN:

🌐 DailyCryptoNews.net

🐦 twitter.com/DCNDailyCrypto

📈 Trader Cobb on X

🌿 The Grow Me Co

Disclaimer

This content is not financial, legal, or tax advice. It reflects personal opinions for educational and entertainment purposes only.

I am not a financial advisor or expert, and I do not guarantee any specific outcome.

Always do your own research before making any investment or financial decisions.

©Copyright 2025 Matthew Aaron Podcasts LLC